But Americans personal income also rose

The Consumer Price Index is the traditional measure of inflation, but lately the Federal Reserve has paid closer attention to the core personal consumption expenditures price index, and that index showed inflation was hotter than expected in February.

The index rose 0.4%, the biggest monthly gain since January 2024, putting the 12-month inflation rate at 2.8%. Wall Street economists were expecting a slightly lower rise.

On the positive side, Americans saw an increase in personal income during February, according to the data released by the U.S. Bureau of Economic Analysis. Personal income rose by $194.7 billion, representing a 0.8% monthly increase. This surge was primarily fueled by increased government social benefits and robust compensation growth.

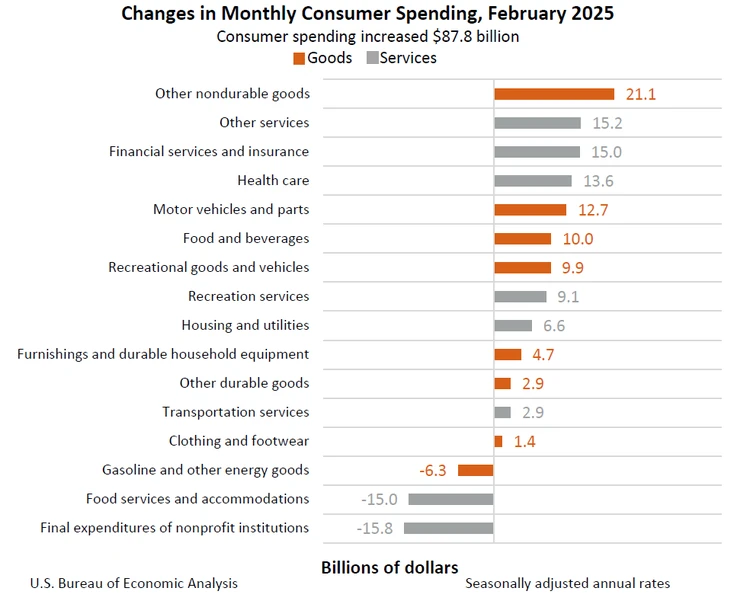

Disposable personal income, which factors in personal current taxes, also saw a substantial rise, climbing by $191.6 billion, or 0.9%. Meanwhile, personal consumption expenditures, a key indicator of consumer spending, increased by $87.8 billion, or 0.4%.

On the inflation front, the PCE price index for February showed a 2.5% increase compared to the same month last year. Excluding food and energy, the PCE price index rose by 2.8% year-over-year.

As shown in the chart below, insurance, healthcare and cars and car parts were big sources of spending in February.

Government social benefits to Americans saw a notable uptick, driven largely by premium tax credits for health insurance purchased through the Health Insurance Marketplace. At the same time, other current transfer receipts were bolstered by business payments to consumers, which included settlements from a domestic medical device manufacturer and a social media company.

Compensation also played a crucial role in the income growth. Private wages and salaries, as reported by the Bureau of Labor Statistics experienced significant gains. Wages and salaries in services-producing industries increased by $35.7 billion, while those in goods-producing industries rose by $12.7 billion.

Because the Fed follows the PCE so closely in making policy, the latest report might reinforce the Feds current position to be in no hurry to reduce interest rates.

Sign up below for The Daily Consumer, our newsletter on the latest consumer news, including recalls, scams, lawsuits and more.

Posted: 2025-03-28 14:26:52