Buy now, pay later hits new highs

Shoppers were more disciplined over Black FridayCyber Monday, prioritizing value

Buy now, pay later services hit new records as consumers spread out payments

In-store traffic fell even as online spending climbed faster than expected

Holiday shoppers took a more calculated approach to Black FridayCyber Monday this year, focusing on stretching budgets and minimizing impulse buys, according to new industry data. Rising prices across essentials and gifts pushed consumers toward a more strategic mindset and toward flexible payment tools.

Buy now, pay later (BNPL) services such as Klarna, Afterpay, Affirm and PayPal Pay Later continued their rapid rise. Adobe Analytics reports BNPL has driven $10.1 billion in spending so far this holiday season, up 9 percent from last year. Cyber Monday set a single-day record with $1.03 billion in BNPL purchases about 7 percent of all online spending.

PayPal said its BNPL transactions jumped 23 percent in the days leading up to Black Friday.

The appeal spans income levels, driven by convenience and the ability to spread out payments, said David Tinsley, senior economist at the Bank of America Institute. Most people remain light users, with just one to four BNPL purchases on their accounts.

Greater availability at checkout is also fueling growth, said Sucharita Kodali, a retail analyst at Forrester. BNPL could also just be going up because e-commerce is going up, she said.

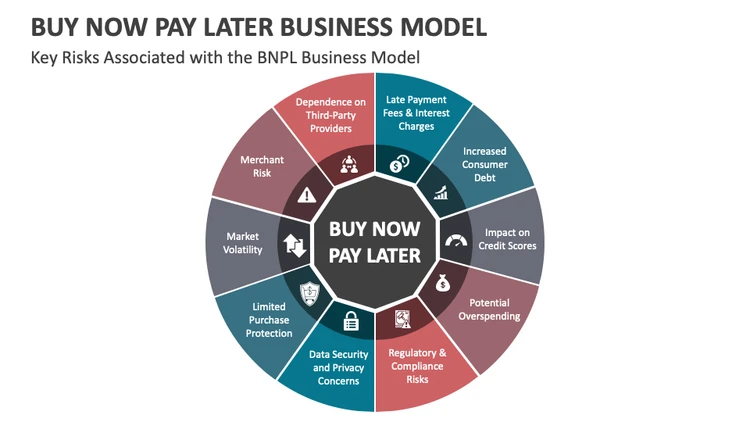

But experts caution that the model isnt risk-free: missed payments can trigger interest charges, and financially vulnerable shoppers may be more susceptible to overspending.

The risks behind BNPLs rapid rise

Mounting debt from small purchases

Experts warn that buy now, pay later services can mask the true cost of purchases. Because payments are split into smaller installments, shoppers may take on more debt than they can comfortably manage especially during the holidays, when spending naturally spikes.

Missed payments can trigger fees or interest

While many BNPL plans are advertised as zero interest, that guarantee usually applies only if payments are made on time. Missed or late installments can lead to interest charges, penalty fees or account restrictions. Some providers also report delinquent payments to credit bureaus, risking long-term credit damage.

Lack of consumer protections

BNPL purchases generally fall outside traditional credit-card dispute frameworks. That can create hurdles for shoppers trying to resolve issues like incorrect charges, damaged goods or returns particularly when multiple retailers and payment platforms are involved.

Higher risk for financially vulnerable households

Analysts say BNPLs appeal is particularly strong among consumers facing tight budgets or limited credit access. These shoppers may rely on the services not for convenience, but necessity increasing the likelihood of missed payments and compounding financial strain.

Overlapping installment schedules

Because many shoppers juggle multiple BNPL plans at once, its easy to lose track of due dates. Overlapping payment schedules can create cash-flow crunches, leading to cascading late fees across several purchases.

Preholiday caution takes hold

With groceries, housing, energy and even key gifting categories rising in price some due to tariffs shoppers are increasingly wary.

People are being cautious, Kodali said. The economy from a retail standpoint has been really positive and this cant go on forever.

That caution shows up in the numbers. The National Retail Federation expects November and December spending to top $1 trillion for the first time, but analysts stress that higher totals largely reflect higher prices, not higher volume.

Online spending surges as stores see declines

Despite broader caution, online sales roared past forecasts. Adobe Analytics recorded $14.5 billion in Cyber Monday sales, up 7.1 percent year over year, and $11.8 billion on Black Friday, a 9.1 percent gain.

Brick-and-mortar stores saw a different pattern. Foot traffic on Black Friday dropped 2.5 percent at malls and 2.6 percent in downtown areas, according to MRI Software. Small Business Saturday declines were steeper, with mall visits down 4.3 percent and downtown traffic off 6 percent.

RetailNext, which tracks activity at more than 560 brands, reported an even sharper drop: traffic fell 3.6 percent on Black Friday and 8.6 percent on Saturday.

The shift doesnt mean shoppers sat out the weekend just that they shopped differently. Shoppers showed theyre done with the impulse-driven, one-day frenzy, said Joe Shasteen, global head of advanced analytics at RetailNext. Prices, tariffs, and tighter budgets pushed people to shop with discipline, not adrenaline.

Essentials rise, but gifts arent forgotten

Consumers also pounced on deals for everyday necessities. Among Shopify sellers, the top product categories were vitamins and supplements, followed by skin care and activewear. Adobe projects online grocery sales will hit $23.5 billion this season, up 9.3 percent from last year.

Were seeing promotions on essentials and the things that consumers feel they need first, said Marshal Cohen, chief retail adviser at Circana.

But even bargain hunters made room for festive splurges. Santa Claus is going to show up and is he going to show up with vitamins? Yeah, Cohen said. But hes also going to show up with a toy here and there.

Posted: 2025-12-02 17:02:07