Furniture, toys, and board games are included in this week's list

February 13, 2026

SOOWERY dressers recalled for tip-over hazard

SOOWERY is recalling a small number of 6-drawer dressers sold on Amazon because they can tip over if not anchored, creating a dangerous entrapment risk for children.

Shenzhen Zhongyuantong Technology Co., Ltd., doing business as SOOWERY, is recalling SOOWERY 6-Drawer Dressers sold in black with a metal frame, wooden top and six collapsible fabric drawers. The company says the dresser can be unstable if it is not anchored to the wall, creating a tip-over and entrapment hazard that can be deadly to children. The product also violates the mandatory clothing storage standard required by the STURDY Act.

The hazard

The dresser can tip if it is not secured, potentially falling onto a child and trapping them underneath. CPSC said the product violates the mandatory standard for clothing storage units, a safety benchmark designed to reduce tip-over injuries and deaths. No incidents or injuries were reported.

What to do

Consumers should stop using the dresser if it is not properly anchored and contact SOOWERY for instructions to receive a refund. Keep children away from any unanchored clothing storage unit until it is secured.

Company contact

Email SOOWERY at SOOWERYrecall@outlook.com.

Source

Beloems bed rails recalled for entrapment risk

Beloems is recalling its adult portable bed rails after regulators said users can become trapped and face a risk of asphyxiation.

- Specific hazard: Entrapment within the rail or between rail and mattress can lead to asphyxiation; also fall and laceration hazards.

- Scope/stats: About 800 units sold on Amazon.com from June 2025 through October 2025 for about $90.

- Immediate action: Stop using the bed rail immediately and contact Beloems for a full refund.

Leioujiapin Technology Co., Ltd., doing business as Beloems, is recalling Beloems-branded adult portable bed rails, model BL-BR201. The foldable rails have white metal tubing, foam handle grips (black or grey), support legs and a fabric pouch, with the Beloems logo printed on the fabric cover. CPSC said the product violates the federal mandatory standard for adult portable bed rails.

The hazard

CPSC said users can become entrapped within the bed rail or between the bed rail and the side of the mattress, posing a serious entrapment hazard and risk of death by asphyxiation. The rails also do not meet structural stability or retention strap requirements, which can lead to falls, and the push pins and pin holes are incorrectly sized, posing a laceration hazard. No incidents or injuries were reported.

What to do

Consumers should immediately stop using the recalled bed rails and contact Beloems for a full refund. To obtain the refund, consumers should destroy the bed rails by cutting the handrails foam padding and writing RECALLED on the upper and lower rails with permanent marker, then take a photo of the destroyed rails and email it as directed by the company.

Company contact

Contact Beloems by email at leioujiapin@163.com.

Source

Fortemotus Direct bed rails recalled for asphyxiation

Fortemotus Direct is recalling adult portable bed rails sold on Amazon because users can become entrapped and face a risk of asphyxiation.

- Specific hazard: Entrapment between the rail and mattress can cause asphyxiation; fall and laceration hazards also cited.

- Scope/stats: About 550 units sold on Amazon.com from August 2025 through October 2025 for about $100.

- Immediate action: Stop using the bed rail immediately and contact the seller for a full refund.

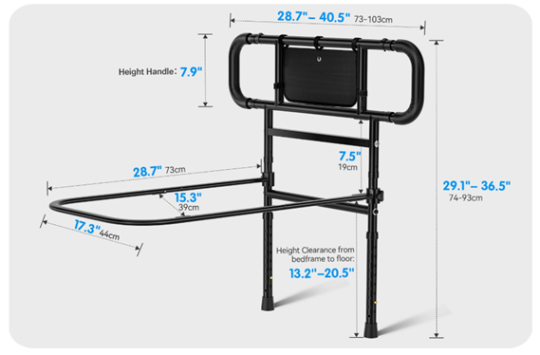

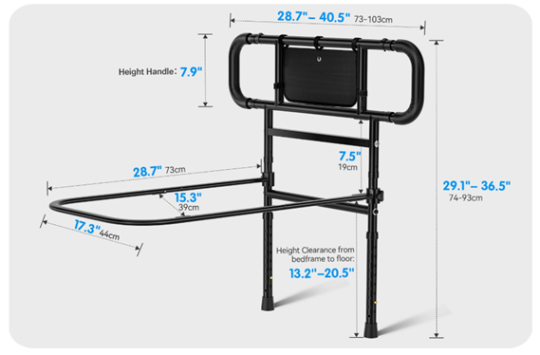

Guangzhou Kezhinuo Maoyi Youxian Gongsi, doing business as Fortemotus Direct US, is recalling Fortemotus-branded adult portable bed rails, model USFTMTJAS008. The black rails have foam handle grips, support legs and a fabric pouch, measure about 30 inches wide by 30 inches high, and have the Foremotus logo printed on the fabric cover. CPSC said the rails violate the mandatory standard for adult portable bed rails.

The hazard

CPSC said users can become entrapped within the bed rail or between the bed rail and the side of the mattress, posing a serious entrapment hazard and risk of death by asphyxiation. The rails also fail structural stability or retention strap requirements, posing a fall hazard, and the push pins and pin holes are incorrectly sized, posing a laceration hazard. No incidents or injuries were reported.

What to do

Consumers should stop using the recalled bed rails immediately and contact Fortemotus Direct US for a full refund. The company instructs consumers to destroy the bed rails by cutting the handrails foam padding, take a photo of the destroyed rails and email the photo to the address provided to receive the refund.

Company contact

Contact Fortemotus Direct US by email at fortemotusofficial@outlook.com.

Source

Magnetic board games recalled over ingestion danger

A Colombia-themed board game set is being recalled because loose, high-powered magnets can be swallowed and cause life-threatening internal injuries.

- Specific hazard: Loose high-powered magnets can be ingested and cause intestinal perforation, twisting or blockage.

- Scope/stats: About 1,200 games sold at Centro Envos Aventura in Miami and online on Amazon.com from April 2023 through June 2025.

- Immediate action: Keep the game away from children and arrange a return for a full refund.

Surveying Accessories Cheaper is recalling Colombia-themed magnetic board games after CPSC said the magnetic pieces can contain loose, high-powered magnets. The recalled sets include a two-sided board, a storage bag, 32 multi-colored magnetic pieces and two dice with a storage pouch; Colombia que linda eres is printed on the board and Cositas Colombianas is printed on the storage box. Only the four- and six-player versions are included in the recall.

The hazard

CPSC said the products violate the mandatory standard for toys because the game pieces can contain loose, high-powered magnets. If swallowed, magnets can attract one another (or other metal objects) inside the body and become lodged in the digestive system, potentially causing perforations, intestinal twisting, blockage, blood poisoning and death. No incidents or injuries were reported.

What to do

Consumers should immediately stop using the recalled magnetic board games and keep them away from children. Contact Surveying Accessories Cheaper to obtain a pre-paid shipping label and return the game for a full refund issued to the original payment method or by check.

Company contact

Call Surveying Accessories Cheaper collect at 305-336-6042 from 9 a.m. to 5 p.m. ET Monday through Friday, or email zlipgo.sales@gmail.com.

Source

LShome smoke alarms recalled for failure to alert

LShome photoelectric smoke detector alarms sold on Amazon are being recalled because the alarm may not sound quickly enough in a fire.

- Specific hazard: Alarm may not warn in time during a fire if the sensing threshold is set too high.

- Scope/stats: About 11,000 3-packs sold on Amazon.com from February 2024 through December 2025 for about $30.

- Immediate action: Stop using the alarms and request a refund through the seller.

TIANJINSHIHAOWEIXINSHENGJIDIANANZHUANGGONGCHENG is recalling LShome 3-pack photoelectric smoke detector fire alarms sold exclusively on Amazon.com. The 9V battery-operated alarms are white and circular with a test button; model XG-7D04-KZ9Z and SKU CX-50YP-A5VN are printed on the bottom. The recall was issued because the device may not sound in a timely manner during a fire.

The hazard

If the sensing threshold is set too high, the alarm might not sound quickly enough to warn occupants, increasing the risk of serious injury or death in a fire. No incidents or injuries were reported.

What to do

Consumers should immediately stop using the recalled smoke alarms and contact the seller for instructions on receiving a full refund through Amazon.com. The firm says the alarms can be discarded in household trash; consumers should ensure they have working smoke alarms in their home as soon as possible.

Company contact

Email lmm15957491237@163.com.

Source

CheerKid bath seats recalled after tipping risk

CheerKid baby bath seats sold on Amazon are being recalled because they can tip over, posing a drowning risk for infants.

- Specific hazard: Unstable infant bath seat can tip during use, creating a drowning hazard.

- Scope/stats: About 590 units sold on Amazon.com in September 2025 for about $35.

- Immediate action: Stop using the bath seat and follow the firms destruction steps to obtain a refund.

Hangzhouyoupengmaoyiyouxiangongsi (Hangzhou Youpeng Trading Co., Ltd.), doing business as Babibaby, and Woot of Carrollton, Texas, are recalling CheerKid-branded baby bath seats sold in gray, pink and light blue. The bath seats have five suction cups on the bottom and a multi-colored rolling abacus toy at the front, with Model: BH-222 on a label on the back. CPSC said the bath seats violate the mandatory federal standard for infant bath seats because they are unstable.

The hazard

The bath seats can tip over while in use, which can submerge an infant and lead to drowning. CPSC said the design violates the mandatory standard for infant bath seats intended to reduce instability risks. No incidents or injuries were reported.

What to do

Consumers should immediately stop using the recalled bath seats and contact Babibaby for a full refund. The firm instructs consumers to write Recalled on the front in permanent marker, disassemble the bath seat by removing the back rest and arm restraints, discard the screws, cut the five suction cups on the bottom, and send a photo of the disassembled and marked product to the company to receive the refund.

Company contact

Email Babibaby at CheerKid-Recall@outlook.com.

Source

Hot Spring spa jets recalled for entanglement

Watkins Manufacturing is recalling certain hydromassage rotary jets in Highlife Collection spas because the jets can create suction that entangles hair and can lead to drowning.

- Specific hazard: Suction from rotary jets can entangle hair and pull a users head underwater.

- Scope/stats: About 32,900 units in the U.S. (plus about 853 sold in Canada) across model years 2023-2025 Highlife Collection spas and replacement parts.

- Immediate action: Stop using the recalled jets and follow the companys instructions to turn them off and install free inserts.

Watkins Manufacturing Corporation is recalling hydromassage rotary jets (6 fin) used in Highlife Collection spas and also sold as replacement parts. The affected spas include eight modelsGrandee, Envoy, Vanguard, Aria, Prodigy, Sovereign, Jetsetter and Jetsetter LXfrom model years 2023, 2024 and 2025. The firm said the jets can create a suction force that can entangle a users hair and pose drowning hazards.

The hazard

The hydromassage rotary jets can create suction that allows hair to become entangled, potentially submerging a users head underwater and creating an entanglement and drowning risk. The company reported one incident involving hair entanglement, and no injuries were reported.

What to do

Consumers should immediately stop using the recalled jets and visit the companys recall website to determine whether their spa includes the affected parts. If the spa has the recalled jets, consumers should contact the company to obtain instructions and a video showing how to turn the jets off and how to install free replacement jet inserts.

Company contact

Contact Watkins Wellness toll-free at 888-450-5748 from 8 a.m. to 5 p.m. ET Monday through Friday, email jetrecall@watkinsmfg.com, or visit http://www.hotspring.com/recalls (or http://www.hotspring.com and click Recalls at the bottom of the page).

Source

Aroeve air purifiers recalled after overheating reports

Airova is recalling Aroeve air purifiers because the units can overheat and ignite, creating fire and burn hazards.

- Specific hazard: Air purifier can overheat and ignite, posing fire and burn hazards.

- Scope/stats: About 191,390 units sold on Amazon.com, Shopify.com, TEMU.com and TikTok.com from September 2024 through June 2025.

- Immediate action: Stop using the purifier and request a free replacement from Airova.

Airova, Inc. is recalling Aroeve brand air purifiers, model MK04, sold in black or white. The recalled units were manufactured prior to July 2025 and have a serial number starting with BN, with model, date code and serial information on a label on the bottom. The company said the units can overheat and ignite.

The hazard

The air purifiers can overheat and ignite, creating a fire and burn hazard. Airova reported 37 overheating incidents, including one report of fire, and said no injuries or property damage were reported.

What to do

Consumers should stop using the recalled air purifiers immediately and contact Airova to obtain a free replacement air purifier. Do not attempt to repair the unit yourself.

Company contact

Email Airova at Aroeve-airpure-recall@outlook.com, or visit https://aroeve.com/pages/product-recall-information (or https://aroeve.com/ and click Product Recalls at the top of the page).

Source

Shein toddler toy set flagged for choking

CPSC is warning consumers to stop using a 5-in-1 toddler musical instrument set sold online because small parts can create a deadly choking hazard for young children.

- Specific hazard: Small parts and spherical-ended drumsticks can obstruct a childs airway; a long cord also poses a safety risk.

- Scope/stats: About 380 units sold online at Shein.com from August 2025 through December 2025 for about $10 to $20.

- Immediate action: Stop using the toys immediately and dispose of them; do not resell or donate.

The U.S. Consumer Product Safety Commission issued a warning urging consumers to immediately stop using 5-IN-1 Toddler Musical Instruments sold online. The set includes items such as bell sticks, a xylophone, maracas and castanets, along with toys like stacking rings with a ball, a shape sorter, a clock puzzle and a fidget snake. CPSC said the product is intended for children under 3 and violates federal safety requirements.

The hazard

CPSC said the products violate the small parts and small ball bans, posing a deadly choking hazard. Regulators also said the drumsticks that come with the xylophone have spherical ends that can pose a choking hazard, and the cord included with the toy clock exceeds 12 inches in length, which violates safety requirements. CPSC urged consumers to report incidents through SaferProducts.gov.

What to do

CPSC urges consumers to stop using the toys immediately and dispose of them so children cannot access the parts. Do not sell or give away the toys. Consumers should report any incidents involving injury or product defect to CPSC at www.SaferProducts.gov.

Company contact

There is no company remedy listed in the CPSC warning; consumers can report incidents to CPSC at www.SaferProducts.gov.

Source

PandaEar hook-on chairs warned for fall risk

CPSC is warning families to stop using PandaEar portable hook-on chairs because a removable crotch restraint can allow a child to fall.

- Specific hazard: Crotch restraint can be removed, increasing the risk of a child falling and suffering serious injury or death.

- Scope/stats: About 8,950 units sold online at Amazon.com from February 2022 through November 2025 for about $25.

- Immediate action: Stop using the chair immediately and dispose of it; do not resell or donate.

The U.S. Consumer Product Safety Commission issued a warning urging consumers to stop using PandaEar childrens portable hook-on chairs. The chairs have a black or gray metal frame covered with black or gray polyester and cotton material, with two metal arms that anchor to a dining table so a child is suspended from the table. CPSC said the products violate the mandatory standard for portable hook-on chairs.

The hazard

CPSC said the crotch restraint can be removed, which can cause a child to slip or fall from the chair, posing a risk of serious injury or death. The products were sold online at Amazon.com and also on pandaear.com and through third-party sellers, according to the agency.

What to do

CPSC urges consumers to stop using the portable hook-on chairs immediately and dispose of them. Do not sell or give away the chairs. Consumers should report any incidents involving injury or product defect to CPSC at www.SaferProducts.gov.

Company contact

There is no company remedy listed in the CPSC warning; consumers can report incidents to CPSC at www.SaferProducts.gov.

Source

Muduo crib bumpers warned after federal ban

CPSC is warning caregivers to stop using Muduo crib bumper sets sold online because the padded bumpers violate the federal crib bumper ban and can cause suffocation.

- Specific hazard: Padded crib bumpers can obstruct an infants breathing, posing a suffocation risk.

- Scope/stats: Sold online at DHGate.com by the seller lilytoy1988.

- Immediate action: Stop using the crib bumpers immediately and dispose of them; do not resell or donate.

The U.S. Consumer Product Safety Commission issued a warning urging consumers to immediately stop using Muduo Crib Bumper Sets sold online. The agency said the padded crib bumpers included in the bedding sets violate the federal ban on crib bumpers. CPSC said the bumpers can obstruct an infants breathing.

The hazard

CPSC said the padded crib bumpers can obstruct an infants breathing, posing a risk of serious injury or death due to suffocation. The agency noted that the product violates the federal crib bumper ban.

What to do

CPSC urges consumers to stop using the crib bumpers immediately and dispose of them so they cannot be used again. Do not sell or give away the crib bumpers.

Company contact

No company contact information was provided in the CPSC warning.

Source

BJs salmon recalled for possible Listeria

Slade Gorton & Co. is recalling one lot of Wellsley Farms farm-raised Atlantic salmon sold at BJs Wholesale Club because it may be contaminated with Listeria monocytogenes.

- Specific hazard: Potential Listeria monocytogenes contamination can cause severe illness, especially for pregnant people and other vulnerable groups.

- Scope/stats: One lot (Lot 3896) with UPC 888670025963 sold in BJs stores across seven states.

- Immediate action: Do not consume the product and contact the company for refund instructions.

Slade Gorton & Co., Inc. announced a recall of one lot of Wellsley Farms Farm-Raised Atlantic Salmon sold at BJs Wholesale Club because the product has the potential to be contaminated with Listeria monocytogenes. The affected product is identified as Lot 3896 with UPC code 888670025963. Distribution was listed for BJs stores in Delaware, Maryland, New Jersey, New York, North Carolina, Pennsylvania and Virgina.

The hazard

Listeria infection can cause short-term symptoms such as high fever, severe headache, stiffness, nausea, abdominal pain and diarrhea, according to the FDA posting. The agency said Listeria infection can also cause miscarriages and stillbirths among pregnant women. Consumers should take extra precautions if they are pregnant, elderly, or have weakened immune systems.

What to do

Consumers should not eat the recalled salmon. Call the company for instructions on how to obtain a full refund and what to do with any remaining product.

Company contact

Consumers can call (888) 628-0730 at any time. Media can call (781) 366-9251 or email Annie.tselikis@sladegorton.com.

Source

Junebar recalls bars for undeclared allergens

Junebar issued an allergy alert for Chocolate Cherry and Peanut Butter Chocolate Chip Junebars due to undeclared milk and soy.

- Specific hazard: Undeclared milk and soy can trigger serious or life-threatening allergic reactions.

- Scope/stats: Lots L1300, L1300A, L1300B, or L1301A distributed in New York State in January 2026.

- Immediate action: People with milk or soy allergies should not eat the bars and should return them for a refund.

Junebar issued an allergy alert for Chocolate Cherry and Peanut Butter Chocolate Chip Junebars because the products may contain undeclared milk and soy. The affected products were distributed in New York State in January 2026 through grocery retailers or direct deliveries from website orders. People with allergies or severe sensitivities to these ingredients are most at risk.

The hazard

The FDA notice warns that consumers with an allergy or severe sensitivity to milk or soy risk a serious or life-threatening allergic reaction if they consume the recalled products. Undeclared allergens are a leading cause of emergency reactions and can be especially dangerous for people with a history of anaphylaxis.

What to do

Consumers who have purchased the recalled Chocolate Cherry or Peanut Butter Chocolate Chip Junebars should not consume them if they have a milk or soy allergy or sensitivity. The company urges consumers to return the product to the place of purchase for a full refund.

Company contact

Call 315-226-3339 or email contact@junebars.com.

Source

TRUE METRIX glucose systems get urgent label update

Trividia Health is issuing a labeling correction for TRUE METRIX blood glucose monitoring systems to stress that users with an E-5 error and symptoms of high glucose should seek immediate medical care.

- Specific hazard: Inadequate instructions could delay treatment during dangerously high blood glucose, risking severe harm or death.

- Scope/stats: All TRUE METRIX, TRUE METRIX AIR, TRUE METRIX GO, and TRUE METRIX PRO systems distributed in multiple countries.

- Immediate action: Follow the updated instructions and seek medical attention immediately if E-5 occurs with high-glucose symptoms.

Trividia Health, Inc. is initiating a labeling correction for all TRUE METRIX Blood Glucose Monitoring Systems, including TRUE METRIX, TRUE METRIX AIR, TRUE METRIX GO, and TRUE METRIX PRO. The FDA notice states that the Owners Booklets/System Instructions for Use do not sufficiently emphasize that users must seek medical attention immediately if they receive an E-5 error code and have symptoms of high glucose. The company said products are not being returned or replaced.

The hazard

Trividia said the lack of emphasis in the instructions could potentially lead to a delay in treatment if a user receives an E-5 error code and is experiencing symptoms of high glucose. The FDA notice warns that delayed treatment may result in serious adverse health consequences or death.

What to do

Consumers should not return the product, as this is a labeling correction rather than a removal from the market. Watch for and follow the companys Product Notice with updated instructions, and seek medical attention immediately if an E-5 error occurs and you have symptoms of high glucose.

Company contact

Contact Trividia Health Customer Care at 1-888-835-2723 or trividia0126CC@trividiahealth.com.

Source

Ground beef recalled over E. coli O145 risk

CS Beef Packers is recalling raw ground beef products that may be contaminated with E. coli O145, with distribution to foodservice locations in three states.

- Specific hazard: Possible contamination with Shiga toxin-producing E. coli (STEC) O145 can cause severe illness and, rarely, kidney failure.

- Scope/stats: FSIS recall 003-2026 for products with case codes 18601, 19583, 19563 and establishment number EST. 630 distributed in CA, ID and OR.

- Immediate action: Foodservice operators should not serve the products and should throw them away or return them.

CS Beef Packers, LLC is recalling raw ground beef products that may be contaminated with E. coli O145, according to the U.S. Department of Agricultures Food Safety and Inspection Service. The affected items include product associated with case codes 18601, 19583 and 19563 and establishment number EST. 630, with distribution listed for California, Idaho and Oregon. FSIS said the products went to foodservice locations.

The hazard

E. coli O145 is a serovar of Shiga toxin-producing E. coli (STEC), FSIS said. Most people infected develop diarrhea (often bloody) and vomiting, and some cases can be more severe; hemolytic uremic syndrome (HUS), a type of kidney failure, is uncommon but can occur. Anyone who becomes ill after consuming ground beef should seek medical care, especially if symptoms are severe or persistent.

What to do

Foodservice locations should not serve the recalled ground beef products. FSIS said the products should be thrown away or returned to the place of purchase to prevent consumers from being exposed.

Company contact

Contact Roger Cooper, Operations Manager of CS Beef Packers, LLC, at 208-810-7510 ext 7531 or roger.cooper@csbeef.com.

Source