Supplements, toys, and household items round out the recalled items

January 30, 2026

Mindbodygreen multivitamin bottles recalled for child poisoning hazard

Mindbodygreen is recalling more than 148,000 bottles of its Ultimate Multivitamin+ supplements due to non-child-resistant packaging that could lead to serious injury or death if ingested by children.

- The supplement bottles contain iron and lack required child-resistant packaging, posing a poisoning risk to children.

- About 148,370 bottles sold online at mindbodygreen.com from November 2021 through November 2025.

- Consumers should secure bottles away from children and request a free child-resistant cap from Mindbodygreen.

Arizona Nutritional Supplements and VitaQuest are recalling Mindbodygreen Ultimate Multivitamin+ dietary supplement bottles after discovering the packaging is not child-resistant. The eight-ounce amber glass bottles, each containing 60 capsules, were sold via mindbodygreen.com for four years and pose a significant poisoning risk to children due to the iron content.

The hazard

The recalled multivitamin bottles contain iron and do not meet the child-resistant packaging standards mandated by the Poison Prevention Packaging Act. Without this safety feature, young children could access and swallow the supplements, risking severe injury or death from iron poisoning. No injuries have been reported to date.

What to do

Consumers should immediately store the bottles out of sight and reach of children. Contact Mindbodygreen to receive a free child-resistant replacement cap. Once secured, the supplements can be used as directed, but the packaging must be updated to ensure safety.

Company contact

Contact Mindbodygreen by email at multi@mindbodygreen.com, or visit shop.mindbodygreen.com/pages/multi-update or www.shop.mindbodygreen.com and click Important Multi packaging update at the bottom of the page for more information.

Source

Hobby Lobby giraffe and llama plush toys recalled for choking risk

Hobby Lobby is recalling over 21,000 giraffe and llama plush toys with clips due to the potential for small beads to become accessible to children, posing a choking hazard.

- The legs of the plush toys can detach, exposing small beads that could choke young children.

- About 21,230 toys sold at Hobby Lobby stores and online from May 2025 to December 2025.

- Consumers should stop use immediately and return toys to any Hobby Lobby store for a full refund.

Hobby Lobby Stores, Inc. is recalling its Giraffe and Llama Plush Toys with clips after reports that the legs can detach, releasing small beads inside. The affected plush toys, sold in-store and online, are brightly colored and feature distinctive labels and tags for identification. One incident of leg detachment has been reported, though no injuries have occurred.

The hazard

When the legs of the plush toys detach, small beads can spill out, creating a significant choking hazard for young children. The toys are not safe for continued use in their current form, especially in homes with toddlers or babies who may put the beads in their mouths.

What to do

Consumers should immediately take the plush toys away from children and return them to the nearest Hobby Lobby store for a full refund. Do not allow children to continue playing with the recalled items.

Company contact

Contact Hobby Lobby Stores toll-free at 800-326-7931 from 9 a.m. to 6 p.m. ET Monday through Friday, email customer.service@hobbylobby.com, or visit www.hobbylobby.com/customer-service/recalls for more information.

Source

Bazic silicone glue recalled for child poisoning and labeling violations

Bazic Products is recalling over 21,000 bottles of its silicone glue because it contains methanol and lacks child-resistant packaging and proper hazard labeling.

- The glue contains methanol and is not in child-resistant packaging, violating federal safety standards and bearing incorrect Non-Toxic labeling.

- About 21,170 bottles with batch code V01233-031725-70004523 sold nationwide and online from May to October 2025.

- Consumers should stop using the glue immediately and contact Bazic Products for a full refund.

Bazic Products, distributed by Bangkit USA Inc., is recalling specific bottles of Bazic Silicone Glue, model 2030, due to packaging and labeling violations. The glue, sold in a transparent bottle with blue nozzle and label, contains methanol and was mislabeled as Non-Toxic. The batch code for affected products is V01233-031725-70004523.

The hazard

The recall was issued because the glue contains methanol, a toxic substance that requires child-resistant packaging under the Poison Prevention Packaging Act. The bottles are not child-resistant and are incorrectly labeled as Non-Toxic, lacking warnings about flammability and toxicity. If ingested by children, methanol can cause severe injury or death. No incidents or injuries have been reported.

What to do

Consumers should stop using the recalled Bazic Silicone Glue immediately. Contact Bazic Products with a photo of the product to receive a full refund. Do not continue to use or store the glue where children can access it.

Company contact

Contact Bazic Products toll-free at 877-772-2942 from 8 a.m. to 5 p.m. PT Monday through Friday or email compliance@bazic.com.

Source

Northern Tool + Equipment hot water pressure washers recalled for fire risk

Northern Tool + Equipment is recalling three models of NorthStar hot water pressure washers after reports that a fan wheel failure can cause abnormal burner operation, smoke, or flames, posing a fire hazard.

- The fan wheel can fail, causing smoke and bursts of flames that pose a fire risk.

- About 1,416 units sold nationwide and online between January and August 2025.

- Consumers should stop using the pressure washers and arrange a free repair through Northern Tool + Equipment.

Northern Tool + Equipment Manufacturing is recalling three models of NorthStar hot water and steam pressure washers due to a defect that can cause the machines to emit smoke or flames. These commercial-grade washers were available both in stores and via online retailers such as Amazon and Ebay from early to mid-2025.

The hazard

The recalled models feature a fan wheel that can fail during operation, potentially resulting in abnormal burner function. This malfunction may cause the pressure washer to emit smoke or sudden bursts of flame, creating a risk of fire or burn injuries. No injuries have been reported as of the recall date.

What to do

Consumers should immediately discontinue use of the affected pressure washers. Contact Northern Tool + Equipment to arrange a free repair at a service center or with an authorized third-party servicer.

Company contact

Contact Northern Tool + Equipment toll-free at 888-518-0342 from 8 a.m. to 5 p.m. CT Monday through Friday, email inquiry@northerntool.com, or visit www.northerntool.com/recall-details-pw for more information.

Source

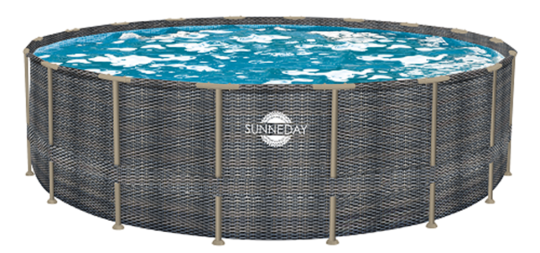

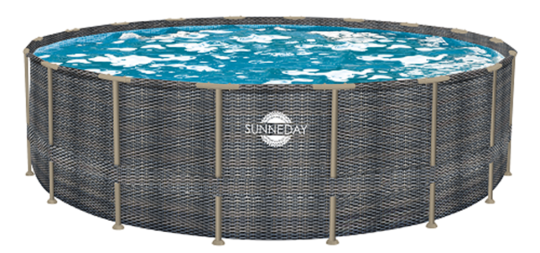

Sunneday and Blue Bay above-ground pools recalled over drowning hazard

Starmatrix Group is recalling nearly 2,400 Sunneday and Blue Bay above-ground pools, 48 inches and taller, because a compression strap on the exterior may allow children to climb into the pool, posing a drowning risk.

- The exterior compression strap creates a foothold, making it easier for children to access the pool unsupervised and risk drowning.

- About 2,390 pools sold on Amazon.com and sunneday.com from January 2024 through October 2025.

- Consumers should keep children away from the pool and contact Starmatrix for a free repair kit.

Starmatrix Group Inc. of China is recalling Sunneday and Blue Bay branded above-ground pools 48 inches and taller after it was found that the compression strap around the pool legs could serve as a step for children. The affected pools were sold online through Amazon and the Sunneday website for up to $1,210, and no injuries have been reported.

The hazard

The compression strap on the outside of the pool's legs creates a potential foothold, enabling a child to climb into the pool without adult supervision. This design flaw increases the risk of accidental drowning for young children who might enter the pool area unnoticed.

What to do

Consumers should immediately prevent children from accessing the pool unattended or drain the pool until the repair kit can be installed. Contact Starmatrix to request a free repair kit to eliminate the foothold hazard.

Company contact

Contact Starmatrix toll-free at (888) 254-2714 from 9 a.m. to 5 p.m. ET Monday through Friday, email info@starmatrix.cn, or visit starmatrix.cn/page-81484.html for more information.

Source

Rear bolts on Trek and Electra electric bicycles recalled for fall hazard

Hyena, Inc. is recalling nearly 20,000 Trek FX+ 1 and Electra Townie Go! electric bicycles after reports that the rear wheel bolts can break, causing the wheel to detach and increasing the risk of a fall.

- Rear wheel bolts may break when torqued, potentially causing the wheel to separate and leading to falls and injuries.

- About 19,890 bicycles sold at Trek stores and online from April to October 2025; seven reports of bolts breaking, no injuries.

- Consumers should stop using the bicycles and schedule a free repair at an authorized Trek or Electra dealer.

Hyena, Inc. of Taiwan has announced a recall of rear wheel bolts used on model year 2026 Trek FX+ 1 and Electra Townie Go! electric bicycles. The recall follows seven reports of bolt breakage that could lead to the wheel coming off during use, with nearly 20,000 bikes affected.

The hazard

The rear wheel bolts on some Trek and Electra e-bikes may break when torqued, causing the wheel to separate from the bicycle frame. This poses a significant fall hazard to riders, though no injuries have been reported as of the recall date.

What to do

Consumers should immediately stop riding bicycles equipped with the recalled bolts. Schedule a free repair at any authorized Trek or Electra dealer, where the original black bolts will be replaced with new silver bolts. Participants will receive a $10 in-store credit valid through the end of 2026.

Company contact

Contact Trek toll-free at 800-373-4594 from 8 a.m. to 6 p.m. CT Monday through Friday or visit trekbikes.com/us/en_US/company/legal_policies/safety_recalls/ for more details.

Source

Sefudun 5% Minoxidil hair growth serum kits recalled for child poisoning risk

Nengmiaokeji is recalling about 7,000 Sefudun 5% Minoxidil Hair Growth Serum Kits because the bottles are not child-resistant, creating a poisoning risk if ingested by children.

- The serum contains minoxidil in bottles lacking child-resistant packaging, violating federal safety requirements.

- About 7,000 kits sold on Amazon.com from December 2023 through August 2025.

- Consumers should secure the serum away from children and contact Nengmiaokeji for a free replacement bottle.

Ganzhounengmiaokejiyouxiangongsi, doing business as Nengmiaokeji, is recalling its Sefudun 5% Minoxidil Hair Growth Serum Kits sold on Amazon. The black glass bottles with dropper caps do not have child-resistant features, putting children at risk if the product is swallowed.

The hazard

The hair growth serum contains minoxidil, a drug that must be kept in child-resistant packaging under federal law. The current packaging does not meet this requirement, posing a risk of serious injury or death from poisoning if ingested by children. No incidents or injuries have been reported.

What to do

Consumers should immediately secure the bottles out of sight and reach of children. Contact Nengmiaokeji for a free replacement bottle. Consumers will need to dispose of the serum by pouring it out, placing the empty bottle in the trash, and emailing a photo to sesuall@outlook.com for verification.

Company contact

Email Nengmiaokeji at sesuall@outlook.com for instructions and replacement information.

Source

Viofairy hair growth serum bottles recalled for child poisoning risk

Guangzhou Runshu BioTech Co., Ltd. is recalling about 8,600 Viofairy Hair Growth Serum bottles due to non-child-resistant packaging, which could result in poisoning if ingested by children.

- The serum contains minoxidil in packaging that is not child-resistant, violating federal safety regulations.

- About 8,600 bottles sold on Amazon.com from January 2024 through September 2025.

- Consumers should keep bottles away from children and contact FDAF for a free replacement after safe disposal.

Guangzhou Runshu BioTech Co., Ltd. is recalling its Viofairy Hair Growth Serum bottles sold on Amazon due to child poisoning risks. The black and gold packaging lacks child-resistant features required for products containing minoxidil, which is potentially dangerous if ingested by children.

The hazard

The serum bottles contain minoxidil, a substance that must be packaged in child-resistant containers under the Poison Prevention Packaging Act. The current packaging does not meet these safety standards, creating a risk of serious injury or death if children access the product. There have been no reported injuries.

What to do

Consumers should secure the bottles away from children immediately. Contact FDAF for instructions on how to safely dispose of the product and receive a free replacement. Consumers will be asked to empty the bottle, discard it, and email a photo to sesuall@outlook.com as proof of destruction.

Company contact

Email FDAF at sesuall@outlook.com for instructions and replacement details.

Source

AiTuiTui pull string teething toys recalled for choking hazard

Vanfun is recalling nearly 50,000 AiTuiTui Pull String Teething Toys sold on Amazon, after reports of choking incidents due to silicone strings that are too small and can reach the back of a child's throat.

- The silicone strings on the teething toy are too small, violating safety standards and posing a risk of choking and respiratory distress.

- About 49,410 toys sold on Amazon.com from August 2022 to September 2025, with 15 choking incidents reported.

- Consumers should immediately destroy the toy and contact Vanfun for a full refund.

Shenzhen Mailesi Technology Co., Ltd., doing business as Vanfun, is recalling all AiTuiTui Pull String Teething Toys due to significant choking hazards. The off-white disc-shaped toy with colored string tentacles and spinning rings was found to violate federal safety standards for toys.

The hazard

The product's silicone strings are smaller than permitted under safety standards and can reach the back of a child's throat, posing a risk of choking, respiratory distress, or even death. The CPSC has received 15 reports of choking and two involving children biting off pieces of the silicone strings.

What to do

Consumers should immediately stop using the teething toy. Cut and discard all string tentacles, mark DESTROYED on the main body, and email a photo of the destroyed toy to recallmls@outlook.com to receive a full refund.

Company contact

Email Vanfun at recallmls@outlook.com for refund instructions.

Source

LuxJet submersible LED lights recalled for battery ingestion hazard

Shenzhen Shimei Lighting Co., Ltd. is recalling over 9,000 sets of LuxJet Submersible LED Lights because the coin batteries inside are easily accessible to children, creating a risk of injury or death if swallowed.

- The lights contain lithium coin batteries that can be accessed by children, violating federal safety standards and lacking required warnings.

- About 9,150 units sold on Amazon.com from January 2022 through November 2025.

- Consumers should stop using the lights and contact LuxJet for a full refund.

Shenzhen Shimei Lighting Co., Ltd., doing business as LuxJet, is recalling its submersible LED light sets after determining that the lithium coin batteries inside the lights and remote controls can be easily accessed by children. The sets include 10 color-changing LED lights and multiple batteries, all lacking appropriate warning labels as required by Reeses Law.

The hazard

The product violates safety standards because the coin batteries are not secured and can be removed by children, who could swallow them. Ingesting button or coin cell batteries can cause severe internal injuries, chemical burns, or death. The lights also lack legally required safety warnings.

What to do

Consumers should stop using the recalled LED lights immediately and contact LuxJet to arrange a full refund. Do not allow children access to the lights or batteries.

Company contact

Email LuxJet at info@luxjet.com.cn for refund instructions.

Source

CPSC warns against JOKOSIS bed rails due to deadly entrapment risk

The CPSC is warning consumers to immediately stop using JOKOSIS Bed Rails sold on Amazon after discovering a risk of entrapment and asphyxiation that could lead to serious injury or death.

- When attached to a bed, the rails can trap users between the rail and mattress, posing deadly entrapment and asphyxiation hazards.

- Sold on Amazon.com from August 2023 through November 2025; other websites may have distributed the product.

- Consumers should stop using and dispose of the bed rails immediately to prevent injury.

The U.S. Consumer Product Safety Commission (CPSC) has issued an urgent warning regarding JOKOSIS Bed Rails, which are black bed rails with zippered pouches and no visible labels. When installed, these rails can create a deadly entrapment hazard for users.

The hazard

JOKOSIS Bed Rails can trap users between the rail and the mattress or within the rail itself, leading to a risk of asphyxiation or fatal entrapment. The product violates mandatory standards for adult portable bed rails, and consumers are strongly urged to stop using them immediately.

What to do

Consumers should immediately stop using the JOKOSIS Bed Rails and dispose of them. Do not sell or give away these hazardous bed rails under any circumstances.

Company contact

Report any incidents or product defects to CPSC at www.SaferProducts.gov.

Source

CPSC warns about Amber Brook pool drain covers for drowning risk

The CPSC is urging immediate removal and replacement of Amber Brook pool drain covers sold on Walmart.com due to missing safety markings and a risk of entrapment and drowning.

- The drain covers lack required safety markings, violating the Virginia Graeme Baker Pool and Spa Safety Act and posing entrapment and drowning hazards.

- Sold online at Walmart.com from August to November 2025.

- Consumers should remove, replace, and dispose of the drain covers before using the pool again.

The CPSC has issued a warning for Amber Brook pool drain covers, which were sold as round, white main drain covers for pools and spas. The covers do not comply with mandatory safety requirements, placing swimmers at risk of deadly entrapment or drowning.

The hazard

The missing product markings on the drain covers mean they do not meet federal safety standards under the Virginia Graeme Baker Pool and Spa Safety Act. This violation increases the risk of swimmers becoming trapped by suction, leading to serious injury or death by drowning.

What to do

Consumers should immediately remove, replace, and dispose of any affected Amber Brook pool drain covers. Pools with the defective covers should not be used until compliant covers are installed. Do not sell or give away these hazardous covers.

Company contact

Report any incidents to the CPSC at SaferProducts.gov.

Source

CPSC warns consumers about Maryhonkui Glow Sticks Party Pack toys for deadly battery ingestion risk

The CPSC is warning against the use of Maryhonkui Glow Sticks Party Pack Toy Sets sold on Amazon due to the risk of children accessing button cell batteries that can cause serious injury or death if swallowed.

- The toy set contains bunny ears, glasses, finger lights, and foam glow sticks with easily accessible button cell batteries.

- Sold on Amazon.com from September 2024 through October 2025; the risk applies to all sets sold.

- Consumers should immediately stop use and dispose of the toys to prevent battery ingestion accidents.

The CPSC is alerting families to immediately stop using the Maryhonkui Glow Sticks Party Pack Toy Sets, which include several components powered by button cell batteries that can be opened by children. The sets feature bunny ears, party glasses, finger lights, and foam glow sticks in multiple colors.

The hazard

Button cell batteries are easily accessible and can be swallowed by children, causing internal burns, severe injuries, or death. The toys violate safety standards for battery protection in childrens products, increasing the risk of accidental ingestion.

What to do

Consumers should immediately stop using all items in the set and dispose of them so they cannot be accessed by children. Do not attempt to repair, sell, or give away these hazardous toys.

Company contact

Report any incidents involving injury or product defect to the CPSC at www.SaferProducts.gov.

Source

CPSC warns against KareKlub plastic tip restraint kits for furniture tip-over risk

The CPSC is warning consumers to stop using KareKlub plastic tip restraint kits, sold as furniture straps, because the plastic can break or degrade and lead to furniture tip-overs, posing risks of injury or death.

- The plastic brackets and cable ties can fail, causing furniture to tip over and potentially trap or injure children or elderly users.

- Sold on Amazon.com; distribution scope includes online purchases nationwide.

- Consumers should remove and dispose of the defective restraints and use compliant tip-over straps instead.

The CPSC is warning consumers that KareKlub plastic tip restraint kits, also called furniture straps, are defective and may fail to secure furniture properly. The kits, which include plastic brackets and zip ties, were distributed through Amazon and may be in use in homes with children or elderly residents.

The hazard

The plastic used in the restraint kits can break or degrade over time, resulting in a loss of structural support. This failure can cause heavy furniture to tip over, creating serious risks of injury or death, especially for children or elderly individuals interacting with the furniture.

What to do

Consumers should immediately remove the KareKlub plastic tip restraints from furniture and dispose of them. Replace them with tip restraint kits that comply with ASTM F3096-23 standards for safety.

Company contact

Report any incidents or product defects to the CPSC at www.SaferProducts.gov.

Source

CPSC warns against BeePrincess bike helmets for head injury risk

The CPSC is warning consumers to stop using BeePrincess adult bike helmets, which fail to meet impact and safety standards and may not protect riders during a crash.

- The helmets violate key safety requirements and may not prevent head injury in an accident.

- Sold on Walmart.com and other platforms from July 2024 through November 2025 in several color options.

- Consumers should cut the straps and dispose of the helmets immediately.

The CPSC has found that BeePrincess adult bike helmets, sold in various colors and sizes, do not meet mandatory standards for impact protection, retention system integrity, positional stability, or required labeling. These helmets were available on Walmart.com and possibly other third-party sellers.

The hazard

The BeePrincess helmets do not comply with federal safety regulations for bicycle helmets. Due to failures in impact attenuation and retention systems, the helmets may not protect riders during a fall or crash, putting users at risk of serious or fatal head injuries.

What to do

Consumers should stop using the BeePrincess helmets immediately, cut the straps, and dispose of the helmets so they cannot be reused or resold.

Company contact

Report any incidents or defects to the CPSC at www.SaferProducts.gov.

Source

Neogen recalls HYCOAT sterile solution for animal use due to contamination risk

Neogen is recalling certain lots of NeogenVet HYCOAT Hyaluronate Sodium Sterile Solution after discovering microbial contamination that could result in infections when used in animals.

- Contaminated lots may not be sterile and can cause infections, especially with intraarticular (joint) use in animals.

- Affected lots distributed nationwide to animal health distributors and veterinarians.

- Users should discontinue use, quarantine the product, and contact Neogen for return instructions.

Neogen is conducting a voluntary nationwide recall of its NeogenVet HYCOAT Hyaluronate Sodium Sterile Solution, a product used in veterinary medicine. Certain lots have been found to be contaminated with microbes and should no longer be considered sterile, posing an infection risk to animalsespecially when administered by injection into joints.

The hazard

This injectable solution is intended to be sterile but may contain microbial contaminants in some recalled lots. Using a contaminated product could cause infections in animals, with increased risk if used intraarticularly. The recall affects multiple lots of both 2 mL/20 mg and 10 mL/50 mg vials.

What to do

Animal health professionals and veterinarians should stop using the affected lots immediately and quarantine the product. Contact Neogen Animal Safety Customer Support for instructions on how to return the product for proper disposal and refund or replacement.

Company contact

Contact Neogen Animal Safety Customer Support at 859-254-1221 or AnimalHealth@neogen.com.

Source

Gerber recalls select Arrowroot Biscuits for possible foreign material

Gerber Products Company is voluntarily recalling limited batches of its Arrowroot Biscuits nationwide due to the potential presence of soft plastic or paper pieces that could pose a choking hazard.

- Certain lots may contain foreign materials such as plastic or paper pieces not meant to be consumed.

- Recalled batches distributed nationwide with over 20 lot codes affected.

- Consumers should not feed the product to children and may return it to the retailer for a refund.

Gerber Products Company has announced a voluntary recall of specific lots of Gerber Arrowroot Biscuits following a supplier recall for possible contamination with soft plastic and/or paper pieces. The recall is issued out of an abundance of caution, and applies to products distributed nationwide.

The hazard

The affected biscuits may contain fragments of plastic or paper, creating a choking hazard if consumed by children. The presence of foreign materials also means the product does not meet Gerbers quality standards for safety and purity.

What to do

Consumers should not feed the recalled Arrowroot Biscuits to children. Return the product to the place of purchase for a refund, or contact Gerber for further assistance.

Company contact

Contact Gerber at 1-800-4-GERBER (1-800-443-7237) for more information.

Source

Koikoi Trading recalls FU ZHOU FISH BALL for undeclared wheat and sesame allergens

Koikoi Trading Inc. is recalling FU ZHOU FISH BALL products in various sizes due to undeclared wheat and sesame that could cause serious or life-threatening allergic reactions in sensitive individuals.

- The fish balls contain wheat and sesame not listed on the label, posing an allergy risk.

- Affected lots distributed through foodservice and e-commerce channels across multiple U.S. states.

- Consumers with allergies should not eat the product and foodservice customers should stop using and segregate affected lots.

Koikoi Trading Inc. is alerting customers to an allergy alert involving its FU ZHOU FISH BALL products in 200g, 400g, and 5lb packages. The recalled products contain undeclared wheat and sesame, which could cause severe allergic reactions in individuals sensitive to these ingredients. Distribution includes foodservice and e-commerce channels with reach across several states.

The hazard

Undeclared wheat and sesame allergens present a serious risk for individuals with allergies or sensitivities. Consuming the affected fish balls could result in anaphylaxis or other severe allergic reactions. The issue affects multiple lot codes identified in the recall.

What to do

Consumers with wheat or sesame allergies should not eat the recalled products. Foodservice customers are advised to stop using, segregate, and label any affected inventory. Contact Koikoi Trading for return, credit, or replacement instructions.

Company contact

Contact Koikoi Trading Inc. at 323-588-9888 or info@koikoitrading.com.

Source

Why Not Natural recalls Organic Moringa for Salmonella risk

Why Not Natural is recalling its Organic Moringa - Green Superfood capsules after routine testing found potential Salmonella contamination, which can cause serious or fatal illness.

- Organic Moringa capsules may be contaminated with Salmonella, a dangerous foodborne pathogen.

- Distributed nationwide via the company's website and Amazon.com; lot #A25G051 affected.

- Consumers should stop using the product and contact Why Not Natural for a full refund.

Why Not Natural of Houston, Texas is voluntarily recalling its Organic Moringa - Green Superfood capsules due to a risk of Salmonella contamination. The affected product, lot #A25G051, was sold nationwide via mail order, company website, and Amazon.com.

The hazard

Salmonella can cause serious and sometimes fatal infections, particularly in young children, the elderly, or those with weakened immune systems. Symptoms may include fever, diarrhea, nausea, vomiting, and abdominal pain. Healthy individuals may experience temporary illness, but in rare cases, infection can become severe.

What to do

Consumers who purchased the recalled Organic Moringa capsules should stop usage immediately. Contact Why Not Natural for instructions on how to return the product for a full refund.

Company contact

Email care@whynotnatural.com for refund instructions and further information.

Source

IKM recalls metal cookware items for lead contamination risk

IKM is recalling metal cookware items sold in California grocery stores after discovering the products may be contaminated with lead, which can cause serious health problems.

- The cookware contains lead, a toxic metal with no safe level of exposure for people of any age.

- Products distributed to grocery stores in multiple California cities, including San Jose, Sacramento, and others.

- Consumers should stop using the cookware and return it to the place of purchase for a full refund.

IKM is recalling metal cookware items after routine testing revealed the presence of lead, which is highly toxic and can cause lasting health issues. The products were distributed through grocery stores in Bay Area and Northern California cities.

The hazard

Lead exposure can result in a range of serious health problems, especially for children and pregnant women. Even low levels of exposure can cause cognitive and developmental delays, as well as other systemic effects. There is no safe exposure threshold for lead in consumer products.

What to do

Consumers should discontinue use of the recalled cookware and return it to the place of purchase for a full refund. Do not continue to use the products for cooking or food preparation.

Company contact

Call 1-650-695-9009 for additional recall and refund information.

Source

Navitas Organics recalls select lots of organic chia seeds for Salmonella risk

Navitas Organics is recalling specific lots of its 8oz Organic Chia Seeds after tests revealed possible Salmonella contamination, a bacteria that can cause serious illness.

- Certain lots of chia seeds may be contaminated with Salmonella, a dangerous foodborne pathogen.

- Product distributed nationally through retail stores and Amazon; affected lot codes are listed in the recall.

- Consumers should discard the chia seeds and return the bag for a refund.

Navitas Organics has announced a recall of select lots of its 8oz Organic Chia Seeds after routine testing indicated the possible presence of Salmonella. The affected chia seeds were sold nationally through retailers such as Whole Foods and online via Amazon.

The hazard

Salmonella infection can lead to serious and sometimes fatal illness, especially in children, seniors, or those with compromised immune systems. Symptoms include fever, diarrhea, nausea, vomiting, and abdominal pain. The risk is greatest for people who may not be able to fight off infection effectively.

What to do

Customers with affected lot codes should open the bag, discard the chia seeds, and make the bag unusable before returning it to the place of purchase for a refund. Do not consume the product.

Company contact

Call the Navitas Organics Consumer Care Team at 855-215-5702 for recall details or refund processing.

Source