Light fixtures, kids' toys, and small kitchen appliances are part of this week's recall roundup

February 27, 2026

Recall Roundup

Trankerloop baby bath seats tip-over risk

Trankerloop is recalling baby bath seats sold on Amazon because the seats can be unstable and tip over, creating a drowning hazard.

- Specific hazard: The infant bath seat can tip during use, raising a risk of serious injury or death from drowning.

- Scope/stats: About 2,380 units were sold on Amazon.com.

- Immediate action: Consumers should stop using the bath seats immediately and contact Trankerloop for a full refund.

Trankerloop (Shenzhenshirongmanshangmaoyouxiangongsi, Shenzhen Shi Ronmang Trading Co., Ltd., of China) is recalling Trankerloop-branded baby bath seats sold in blue, gray, pink and yellow. The bath seats have two detachable restraint arms, four suction cups on the bottom, and come with a cup and sponge; PLASTIC STOOL and Model: YD-1958 appear on a tracking label on the back. The recall was issued because the seats violate the mandatory standard for infant bath seats due to instability.

The hazard

CPSC said the bath seats are unstable and can tip over while in use. A tip-over in a bath seat can quickly lead to submersion and drowning risk for infants and toddlers. No incidents or injuries have been reported.

What to do

Consumers should immediately stop using the recalled bath seats and keep them away from children. Contact Trankerloop to request a full refund.

Company contact

Trankerloop at 405-204-8540 from 9 a.m. to 3:30 p.m. CT Monday through Friday, or by email at hkkll147@outlook.com.

Source

Tubby Tots bath foam set impact hazard

Surreal Brands is recalling a batch of Tubby Tots Fizzy Flask Bath Magic sets after reports that pieces can eject forcefully when opened.

- Specific hazard: Pressure can build inside the container, causing pieces to shoot out when opened and strike users.

- Scope/stats: About 9,400 sets were sold in the U.S. (plus about 600 in Canada), priced about $14-$15.

- Immediate action: Consumers should stop using the recalled sets and contact Surreal Brands for a full refund, following disposal instructions.

Surreal Brands LLC is recalling Tubby Tots Fizzy Flask Bath Magic bath foam sets. The sets include six bath bomb potions packaged in clear plastic flasks and color-coded boxes; the recalled batch number 082025 is printed on the back of the larger outer box. The recall covers sets sold on Amazon.com, wonderfunbrands.com, and TikTokShop@Wonderfun_Brands from November 2025 through January 2026.

The hazard

Moisture trapped inside the bath foam set container can cause pressure to build, and pieces can be forcefully ejected when the container is opened, CPSC said. The company received three reports of pieces ejecting; two consumers reported bruises and swelling after being struck in the arm and face, including one report of a chipped tooth.

What to do

Consumers should immediately stop using the recalled plastic flask bath foam sets and request a refund. The firm instructs consumers to register at www.wonderfunbrands.com/recall, permanently mark the plastic flasks with the word Recalled, and dispose of them in a sealed garbage bag for household waste collection.

Company contact

Surreal Brands by email at recall@wonderfunbrands.com, or online at www.wonderfunbrands.com/recall or https://wonderfunbrands.com (click Recalls at the bottom of the page).

Source

KiddoSpace flashcard toy chemical exposure risks

TheKiddoSpace is recalling childrens flashcard talking toys due to excessive lead and phthalates and an electrical safety issue.

- Specific hazard: The toys contain lead and phthalates above federal limits and also fail short-circuit protection requirements.

- Scope/stats: About 4,000 units sold via TheKiddoSpaceStore.com and Amazon.com for $30-$50.

- Immediate action: Consumers should take the toys away from children and contact TheKiddoSpace for a free replacement toy or a free USB cable, including shipping.

SN Commerce LLC, doing business as TheKiddoSpaceStore, is recalling KiddoSpace Childrens Flashcard Talking Toys. The recall affects units sold on TheKiddoSpaceStore.com and Amazon.com from October 2023 through February 2025. CPSC said the products violate federal bans on lead and phthalates in childrens products and also violate the mandatory standard for toys.

The hazard

Testing found lead levels that exceed the federal lead content ban and phthalate levels that exceed the federal phthalates ban, according to CPSC. Lead and phthalates are toxic if ingested by young children and can cause adverse health issues. CPSC also said the flashcards fail to comply with the short-circuit protection requirement for battery-operated toys, adding an additional safety concern. No incidents or injuries have been reported.

What to do

Stop using the recalled toys immediately and keep them out of childrens reach. Contact TheKiddoSpace to receive a free replacement toy or a free USB cable, including shipping.

Company contact

TheKiddoSpace by email at info@thekiddospace.com, or online at www.thekiddospacestore.com/pages/product-recalls/flashcards or www.thekiddospacestore.com (click Product Safety Recalls at the bottom of the page).

Source

TheKiddoSpace sensory swing strangulation danger

TheKiddoSpace is recalling its cocoon-style sensory swing because flexible fabric can form loops that may entangle a child.

- Specific hazard: Loops formed by the swings fabric can entangle a childs head or neck, posing a strangulation risk.

- Scope/stats: About 140 swings were sold on TheKiddoSpaceStore.com for $50-$80.

- Immediate action: Consumers should stop using the swing and contact TheKiddoSpace for a full refund after destroying the product as directed.

SN Commerce LLC, doing business as TheKiddoSpaceStore, is recalling TheKiddoSpaces sensory swing sold for indoor therapeutic or recreational use. The recalled product is a stretchable, cocoon-style hammock swing sold in solid colors (green, gray, blue and pink) and themed prints (ocean, jungle, space and fairytale) and packaged with installation hardware and a blue drawstring bag with the TheKiddoSpace logo. The swings were sold on TheKiddoSpaceStore.com from November 2023 through February 2025.

The hazard

CPSC said the swings flexible fabric can form loops that can entangle a childs head or neck. That entanglement can lead to strangulation, a risk of serious injury or death. No incidents or injuries have been reported.

What to do

Consumers should stop using the recalled swings immediately and keep them away from children. Contact TheKiddoSpace for a full refund; consumers will be asked to destroy the swing by cutting the fabric in half, email a photo of the destroyed swing to info@thekiddospace.com, and then dispose of the swing.

Company contact

TheKiddoSpace by email at info@thekiddospace.com, or online at thekiddospacestore.com/pages/product-recalls/sensory-swings or www.thekiddospacestore.com (click Product Safety Recalls at the bottom of the page).

Source

Royal Oak Flame Saber lighters lack child resistance

Royal Oak Enterprises is recalling Flame Saber multipurpose lighters because required child-resistant features are missing, increasing fire and burn risks.

- Specific hazard: The lighter may be easier for children to operate, raising the risk of fire and burn injuries; required safety labeling is also missing.

- Scope/stats: About 190,560 lighters were sold nationwide in stores and online for about $30.

- Immediate action: Consumers should stop using the recalled lighters and contact Royal Oak for a full refund after destroying the device as instructed.

Royal Oak Enterprises, LLC, doing business as Royal Oak of Roswell, Georgia, is recalling Royal Oak Flame Saber Lighters. The red lighters have a black-and-gray checkered grip and a hands-free operation lock, and bear warning labels including DANGER: Extremely Flammable, Content Under Pressure and WARNING: Only store in locked position, with the Royal Oak logo on the front. They were sold at Lowes, Home Depot, Tractor Supply, Rural King and Ace Hardware and online from November 2023 through October 2025.

The hazard

CPSC said the lighters violate the mandatory standard for multipurpose lighters because they do not have required child-resistant mechanisms, which can increase the risk of serious injury or death from fire and burn hazards. The agency also said the product violates Federal Hazardous Substances Act labeling requirements because required safety information is missing. No incidents or injuries have been reported.

What to do

Consumers should immediately stop using the recalled lighters and keep them away from children. Contact Royal Oak for a full refund; consumers will receive instructions on how to destroy the lighter and submit proof of destruction to obtain the refund.

Company contact

Royal Oak toll-free at 877-567-9324 from 8 a.m. to 5 p.m. ET Monday through Friday, via email at RoyalOak5955@sedgwick.com, or online at www.royaloakflamesaberrecall.expertinquiry.com or royaloak.com (click Recall at the top of the page).

Source

PQL high bay LED fixtures fire risk

PQL is recalling certain High Bay Linear LED light fixtures because internal retaining pins can degrade, allowing an LED board to come loose and potentially start a fire.

- Specific hazard: A loose LED board inside the fixture can create a fire hazard.

- Scope/stats: About 186,520 fixtures sold from 2016 through June 2025; one fire report and no injuries.

- Immediate action: Consumers should stop using the fixtures and contact PQL for free replacement retaining pins.

Jiangsu Ever-Tie Lighting Co., Ltd., of China, is recalling High Bay Linear LED light fixtures sold under the PQL recall notice. The rectangular, white, metal fixtures were sold in 2-foot and 4-foot-wide configurations through stores nationwide, including LED Indy, Universal Lighting of America, Inc., and Independent Lighting, and also online from January 2016 through June 2025. The issue involves retaining pins used to secure the LED board inside some units.

The hazard

The retaining pins in some fixtures can degrade, allowing the LED board to come loose inside the fixture, CPSC said. A loose component inside an energized lighting fixture can overheat or create arcing conditions, posing a fire hazard. The firm has received one report of a light fixture catching fire; no injuries were reported.

What to do

Consumers should immediately stop using the High Bay Linear LED light fixtures and contact PQL for free replacement retaining pins. Consumers should register their product at https://pqlighting.com/product-recall-notice to receive the repair parts and follow the companys instructions for installation.

Company contact

PQL toll-free at 805-416-5251 from 8:30 a.m. to 5 p.m. CT Monday through Friday, email safety@pqlighting.com, or online at https://pqlighting.com/product-recall-notice or https://pqlighting.com (click Resources then Safety Recall Form).

Source

Montessori puzzle eggs choking hazard for toddlers

TheKiddoSpace is recalling Montessori-style puzzle egg toys because the eggs can block a young childs airway.

- Specific hazard: The plastic eggs can obstruct a childs airway, posing a choking and death hazard.

- Scope/stats: About 200 toys sold on TheKiddoSpaceStore.com from June 2023 through February 2025.

- Immediate action: Consumers should stop using the recalled toys and contact TheKiddoSpace for a refund.

SN Commerce LLC, doing business as TheKiddoSpaceStore, is recalling TheKiddoSpace-branded Montessori childrens puzzle egg toys. The toys include six or 12 white plastic eggs that split in half and come in a yellow storage case, with colored geometric shapes that match between halves. CPSC said the product is intended for children under 3 and presents a choking hazard.

The hazard

CPSC warned the eggs can block a childs airway, posing a risk of choking and death to children. Products intended for very young children are subject to strict size and safety requirements because airway blockages can occur quickly. No incidents or injuries have been reported.

What to do

Consumers should stop using the recalled puzzle egg toys immediately and keep them out of childrens reach. Contact TheKiddoSpace to request a refund and follow the companys instructions for next steps.

Company contact

TheKiddoSpace by email at info@thekiddospace.com, or online at www.thekiddospacestore.com/pages/product-recalls/geometry-egg or www.thekiddospacestore.com (click Product Safety Recalls at the bottom of the page).

Source

Babysense Max View monitor charging fire hazard

Hisense is recalling the display unit of the Babysense Max View Baby Monitor after reports the parent unit can overheat or spark while charging.

- Specific hazard: The display/parent unit can overheat and/or spark during charging, posing a fire hazard.

- Scope/stats: About 81,800 units sold online from January 2023 through December 2025; 11 incident reports and no injuries.

- Immediate action: Consumers should stop using the display unit immediately and contact Hisense for a free replacement display unit.

Hisense Ltd., of Israel, is recalling the Babysense Max View Baby Monitor display unit (the parent unit) with model number VBM55. The recall does not involve the camera component placed in the childs room; it focuses on the display unit labeled 5.5 HD 1080P on the screen and babysense on the lower portion, with VBM55RX on the back label. The monitors were sold at Amazon.com, Walmart.com and babylist.com from January 2023 through December 2025.

The hazard

The display/parent unit can overheat and/or spark when charging, creating a fire hazard, CPSC said. Hisense reported receiving 11 incident reports involving the display unit. No injuries have been reported.

What to do

Consumers should stop using the display unit of the Max View baby monitors immediately and keep it unplugged. Contact Hisense to obtain a free replacement display unit that does not pose a fire hazard, and follow the companys return or replacement instructions.

Company contact

Hisense toll-free at (833) 689-2652 from 9 a.m. to 5 p.m. ET Monday through Friday, by email at support@recallsecure.com, or online at www.recallsecure.com or www.babysensemonitors.com (click Product Recalls at the top of the page).

Source

Evajoy above-ground pools child access drowning hazard

Evajoy is recalling 48-inch and taller above-ground pools because an exterior compression strap can act as a foothold for children.

- Specific hazard: A compression strap may create a foothold, allowing a child to climb into the pool and drown.

- Scope/stats: About 4,000 pools sold on Amazon.com from March 2023 through June 2024.

- Immediate action: Consumers should contact Evajoy for a free repair kit that removes the compression strap while maintaining pool integrity.

Shenzhen Danya Tech Co., Ltd., doing business as Evajoy of China, is recalling Evajoy 48-inch and taller above-ground pools. The pools were sold on Amazon.com from March 2023 through June 2024 for about $550 to $1,050, depending on size, model and accessories. The concern involves an exterior compression strap that runs around the outside of the pool legs.

The hazard

CPSC said the compression strap may create a foothold that can help a child climb into the pool. Unsupervised access to water is a leading contributor to drowning incidents, and even a brief lapse can be dangerous. No incidents or injuries have been reported.

What to do

Consumers should contact Evajoy to request a free repair kit designed to remove the compression strap from the pool while maintaining structural integrity. Until the fix is installed, consumers should take steps to prevent child access consistent with local safety guidance, including supervision and barriers where feasible.

Company contact

Evajoy toll-free at 888-846-2988 from 9 a.m. to 5 p.m. PT Monday through Friday, email support@evajoy.co, or online at https://evajoy.co/pages/poolrecall or www.evajoy.co (click on Product Recalls at the top of the page).

Source

Peg dolls in cups toy choking risk

TheKiddoSpace is recalling peg dolls in cups toys because the peg dolls can block a young childs airway, violating the small parts ban.

- Specific hazard: Small wooden peg dolls can obstruct a childs airway, posing choking and death risks.

- Scope/stats: About 40 toys sold on TheKiddoSpaceStore.com for about $30.

- Immediate action: Consumers should stop using the toys and contact TheKiddoSpace for a refund, then mark the pieces and dispose of them as instructed.

SN Commerce LLC, doing business as TheKiddoSpaceStore of Dover, Delaware, is recalling TheKiddoSpace-branded peg dolls in cups toys. The set includes seven rainbow-colored wooden peg figures, a matching cup, and a circular natural wood tray, packaged in a blue box labeled with TheKiddoSpace logo and Peg Dolls in Cups. The toys were sold on TheKiddoSpaceStore.com from July 2023 through February 2025.

The hazard

CPSC said the recalled toys are intended for children under 3 years old and the peg dolls can block a childs airway, creating a choking hazard that can lead to serious injury or death. The product also violates the small parts ban for toys intended for young children. No incidents or injuries have been reported.

What to do

Consumers should stop using the recalled toys immediately and keep them out of childrens reach. Contact TheKiddoSpace for a full refund; consumers will be asked to write RECALLED in permanent marker on the pieces and email a photo of the marked toys to info@thekiddospace.com, then dispose of the toys.

Company contact

TheKiddoSpace by email at info@thekiddospace.com, or online at www.thekiddospacestore.com/pages/product-recalls/peg-dolls or www.thekiddospacestore.com (click Product Safety Recalls at the bottom of the page).

Source

Gourmia pressure cooker lid opening burn hazard

CPSC is urging consumers to stop using Gourmia pressure cookers after reports the lid can open while pressurized, spraying hot contents.

- Specific hazard: The lid can open while the cooker is still pressurized, causing hot food or liquid to spray out and burn users.

- Scope/stats: Sold from 2017 to 2020 at Best Buy and other retailers for $50-$80; multiple burn injuries have been reported.

- Immediate action: Consumers should stop using the pressure cookers immediately and dispose of them; do not sell or give them away.

The U.S. Consumer Product Safety Commission issued a warning urging consumers to immediately stop using Gourmia digital pressure cookers, model GPC625. The six-quart cookers have stainless steel and black plastic finishes, a pressure lid, and a digital display with button controls. CPSC said the design can allow the lid to open while the unit remains pressurized, creating a serious burn risk.

The hazard

According to CPSC, the lid can open while the cooker is still pressurized, causing hot contents to spray out. The agency said severe second-degree burn injuries have been reported in connection with the hazard. Because pressurized contents can eject suddenly, consumers are urged to treat the product as unsafe to use.

What to do

CPSC urges consumers to stop using the pressure cookers immediately and dispose of them. Do not sell or give away these pressure cookers, and report any incidents involving injury or a product defect to CPSC at www.SaferProducts.gov.

Company contact

Report incidents to CPSC at www.SaferProducts.gov.

Source

GO Raw expands Quest cat food thiamine recall

GO Raw LLC expanded a voluntary recall of Quest Diet Cat Food Products due to low thiamine levels that can lead to deficiency in cats.

- Specific hazard: Low thiamine (Vitamin B1) over time can cause gastrointestinal and neurological illness in cats.

- Scope/stats: Affected lots include Lot #C25288; MCD25350; MCC25321 with UPC 6-91730-17104-9, distributed nationwide.

- Immediate action: Consumers should stop feeding the affected product and return it for a full refund or replacement.

GO Raw LLC expanded its voluntary recall of Quest Diet Cat Food Products after identifying products that may contain low levels of thiamine (Vitamin B1). The company also enacted a stop sale of all Quest products, according to the FDA posting. The affected products were distributed nationwide, including in states such as CO, UT, WA, OR, PA, RI, MI, CA, TX, IL, GA, NC, SC, FL, MN, NY, OH, WI, ID and MT.

The hazard

Cats fed diets low in thiamine over time can develop thiamine deficiency, which may begin with decreased appetite, salivation, vomiting, failure to grow, and weight loss. In advanced cases, neurological symptoms can occur, including ventroflexion of the neck, mental dullness, vision changes, wobbly walking, circling, falling, and seizures. The recall is tied to products with Lot #C25288; MCD25350; MCC25321 and UPC 6-91730-17104-9.

What to do

Consumers who purchased the affected product should stop feeding it to cats immediately. Return the product to the place of purchase for a full refund or replacement, and consult a veterinarian if a pet shows symptoms consistent with thiamine deficiency.

Company contact

Email cs@gorawllc.com or call 801-432-7478.

Source

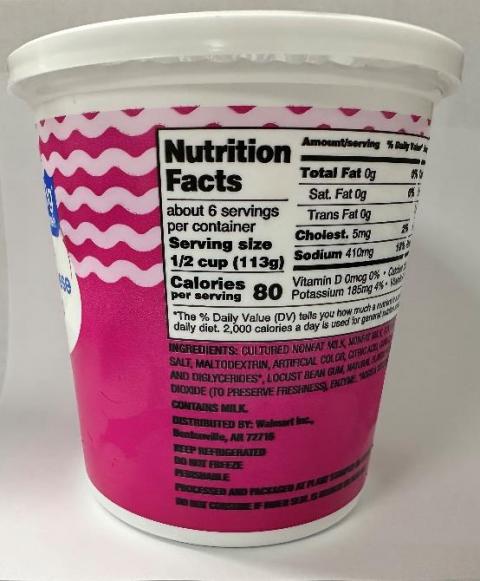

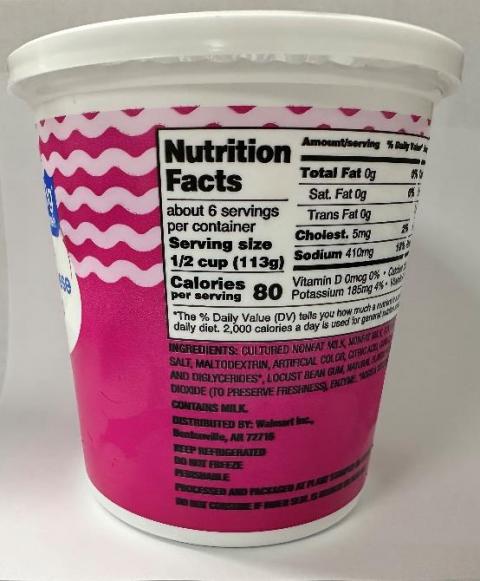

Great Value cottage cheese recall for pasteurization issue

Saputo USA is voluntarily recalling certain Great Value Cottage Cheese products because they may not have been fully pasteurized.

- Specific hazard: Not fully pasteurized dairy products can pose a significant health risk, especially for young children, older adults, and immunocompromised people.

- Scope/stats: Distributed to Walmart stores and distribution centers in multiple states; identified by specific UPCs and Best If Used By dates in early April 2026.

- Immediate action: Consumers should not eat the affected product and should dispose of it or return it for a full refund.

Saputo USA is voluntarily recalling Great Value Cottage Cheese because the product may not have been fully pasteurized, according to an FDA notice. The affected items were distributed to Walmart stores and distribution centers across numerous states including Alaska, Alabama, Arkansas, Arizona, California, Colorado, Georgia, Iowa, Idaho, Illinois, Kansas, Kentucky, Louisiana, Missouri, Mississippi, Montana, New Mexico, Nevada, Oregon, Texas, Tennessee, Utah, Washington and Wyoming. Consumers are advised to check UPCs and Best If Used By dates.

The hazard

The FDA notice warns that consuming products that are not fully pasteurized can pose a significant health risk, particularly to the young and elderly or immunocompromised individuals. Consumers should identify affected products using UPCs 078742373393, 078742116730, 078742372358, 078742372365, and 078742147970, with Best If Used By dates APR-01-26, APR-02-26, and APR-03-26.

What to do

Customers who purchased the affected products should not consume them. Dispose of the product safely or return it to Walmart for a full refund.

Company contact

Call Saputo at 1-888-587-2423.

Source

Boner Bears chocolate syrup recalled for hidden drug ingredient

Lockout Supplements is recalling Boner Bears Chocolate Syrup nationwide because it contains undeclared sildenafil, which can dangerously interact with certain medications.

- Specific hazard: Undeclared sildenafil can interact with nitrates (such as nitroglycerin) and cause dangerously low blood pressure.

- Scope/stats: All lots from 01/01/25 through 02/13/26 with UPC 000856683570, sold nationwide via lockoutsupplements.com.

- Immediate action: Consumers should stop using the product and return it or discard it as directed.

Lockout Supplements issued a voluntary nationwide recall of Boner Bears Chocolate Syrup after testing or review found undeclared sildenafil. The product was sold nationwide over the internet at lockoutsupplements.com. The recall applies to all lots from 01/01/25 to 02/13/26 with UPC 000856683570.

The hazard

Sildenafil is an active ingredient in FDA-approved prescription drug products for erectile dysfunction, but it can pose serious health risks when taken unknowingly. The FDA notice warns the undeclared ingredient may interact with nitrates found in certain prescription drugs, such as nitroglycerin, and may lower blood pressure to dangerous levels.

What to do

Consumers who have Boner Bears Chocolate Syrup should stop using it immediately. Return the product to the place of purchase where applicable or discard it, and contact the company for additional instructions if neededespecially if you take nitrate medications or have underlying heart conditions.

Company contact

Call 972 548-1988 or email glenn@lockoutforums.com.

Source

Elite Treats dog chicken chips recalled for Salmonella

Elite Treats LLC is recalling a single lot of Chicken Chips for Dogs due to potential Salmonella contamination that can sicken pets and people.

- Specific hazard: Salmonella exposure can cause illness in pets and serious infections in people who handle the product or contact contaminated surfaces.

- Scope/stats: 6-ounce bags stamped with lot 24045 and expiration date 04/2027, distributed to feed stores in five states.

- Immediate action: Consumers should stop using the treats, dispose of them securely, and sanitize bowls and storage containers; contact the company for a refund or replacement.

Elite Treats LLC is recalling a single lot of Elite Treats Chicken Chips for Dogs after the product tested positive or may be contaminated with Salmonella, according to an FDA notice. The affected items are 6-ounce bags stamped with lot number 24045 and an expiration date of 04/2027. The product was sold to Florida Hardware, LLC, which sold it to feed stores in Alabama, Florida, Georgia, North Carolina and South Carolina.

The hazard

Salmonella can cause illness in pets that eat contaminated treats, and people can be exposed by handling contaminated products, contacting pets who have eaten the product, or touching contaminated surfaces. In people, Salmonella can cause serious and sometimes fatal infections, the FDA warned. Households with young children, older adults, pregnant people, or immunocompromised individuals may face higher risk.

What to do

Consumers who purchased 6-ounce bags of Elite Treats Chicken Chips for Dogs stamped with lot 24045 should stop using them immediately and should not sell or donate the recalled product. Dispose of it in a way that children, pets and wildlife cannot access it, and wash and sanitize pet food bowls, measuring cups, and storage containers. Contact the company for a refund or replacement.

Company contact

Email elite.treats@yahoo.com or call 561-901-5310.

Source

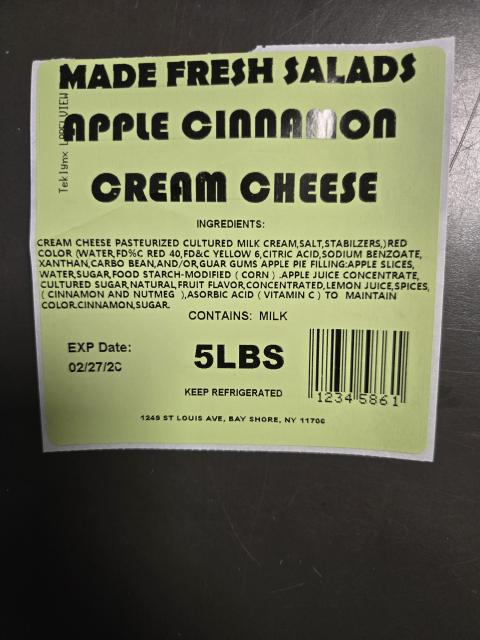

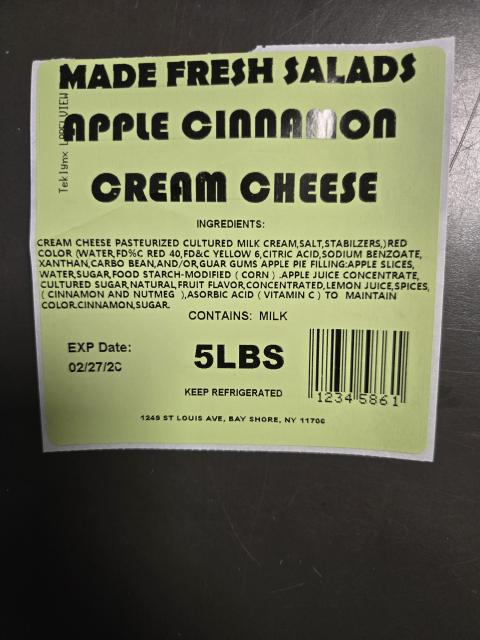

New York-area cream cheese recall for Listeria concern

Made Fresh Salads, Inc. is recalling assorted cream cheese flavors and a tofu spread in the New York City area due to potential Listeria contamination.

- Specific hazard: Possible Listeria monocytogenes contamination can cause severe illness, especially in vulnerable populations.

- Scope/stats: Products with expiration dates through February 27, 2026, distributed in Brooklyn, Queens, the Bronx and the New York City area.

- Immediate action: Consumers should not eat the products and should return them to the place of purchase for a full refund.

Made Fresh Salads, Inc. is recalling assorted flavors of cream cheese and a tofu spread because the products have the potential to be contaminated with Listeria monocytogenes, according to an FDA notice. The affected items were distributed in Brooklyn, Queens, the Bronx and the New York City area. The notice identifies products with expiration dates through February 27, 2026.

The hazard

Listeria monocytogenes can cause serious and sometimes fatal infections, particularly in young children, frail or elderly people, and others with weakened immune systems, the FDA said. Consumers who are pregnant are also typically advised to avoid Listeria-risk foods because infection can be severe for both parent and fetus.

What to do

Consumers who have purchased Made Fresh Salads cream cheese products covered by the recall should not eat them. Return the product to the place of purchase for a full refund, and contact a health care provider if symptoms develop after consumption.

Company contact

Call 1-718-765-0082.

Source

Aldi meatballs recalled after possible metal contamination

Rosina Food Products is recalling Bremer frozen Italian-style meatballs sold at Aldi nationwide due to possible metal contamination.

- Specific hazard: Possible foreign matter contamination (metal) can cause injury if consumed.

- Scope/stats: 32-oz bags with BEST BY 10/30/26 and specific timestamps; shipped to Aldi locations nationwide (FSIS Class I).

- Immediate action: Consumers should not eat the meatballs and should throw them away or return them for a refund.

Rosina Food Products, Inc. is recalling ready-to-eat frozen meatball products labeled Bremer FAMILY SIZE ITALIAN STYLE MEATBALLS, according to the U.S. Department of Agricultures Food Safety and Inspection Service (FSIS). The recall was issued due to possible foreign matter contamination, specifically metal. The products were shipped to Aldi supermarket locations nationwide.

The hazard

FSIS said the meatballs may contain metal, which can pose a serious health risk if swallowed, including mouth injuries or internal damage. The recall is categorized as Class I (high or medium risk), meaning there is a reasonable probability that use of the product will cause serious, adverse health consequences or death. Affected packages are 32-oz printed poly film bags with a BEST BY date of 10/30/26 and timestamps between 17:08 through 18:20, with establishment number EST. 4286B.

What to do

Consumers who purchased the affected meatballs should not consume them. Throw the products away or return them to the place of purchase for a refund, and seek medical attention if you believe you were injured after eating the product.

Company contact

Customer Service, Rosina Food Products, Inc., at 1-888-767-4621 or CService@rosina.com.

Source