Websites, apps also affected by protests and 'economic blackouts'

Key takeaways:

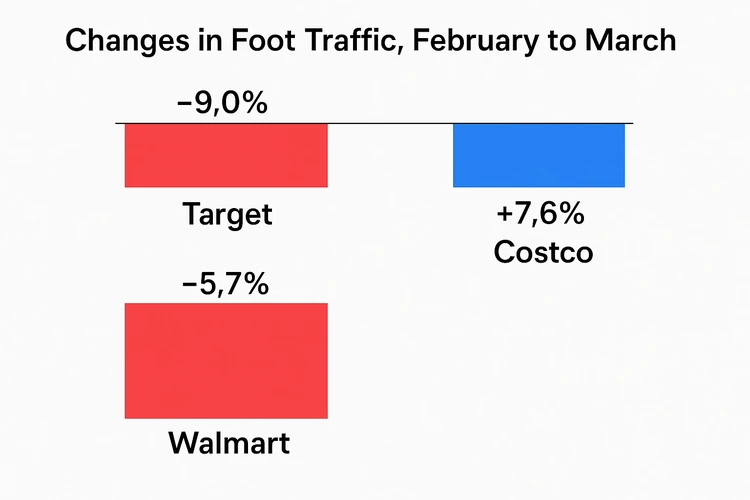

- Target and Walmart saw foot traffic fall up to 9% amid shopper boycotts over DEI rollbacks

- Website and app traffic also dipped as protests and economic blackouts took hold

- Costco, which maintained DEI efforts, saw increases in both digital and in-store traffic

The nation's two largest big-box retailersTarget and Walmartare feeling the sting of coordinated consumer boycotts, with new data showing significant declines in store visits, app usage, and web traffic over recent months. Meanwhile, rival Costco appears to be reaping the benefits, drawing in customers while doubling down on its diversity, equity, and inclusion (DEI) commitments.

Protests take a toll on traffic

According to Placer.ai, Targets foot traffic fell 9% in February and 6.5% in March compared to the previous year. Walmart experienced a 5.7% drop in February and 3.9% in March.

The footfall declines follow protests led by Peoples Union USA and faith leader Rev. Jamal Bryant, both of whom targeted the retailers for pulling back on DEI initiatives.

On February 28, during a "24-Hour Economic Blackout," Target saw its website visits fall from 5.2 million to 4.7 million, and its app traffic nosedive 14%, from 4.2 million to 3.5 million, according to SimilarWeb. Walmart posted smaller digital losses that day, with web traffic down 5% and app usage falling 2%.

A second boycott, dubbed Economic Blackout 2.0, took place over Easter weekend, targeting Walmart over broader complaints of corporate greed. Walmart and Target have not commented publicly on the traffic trends or the protests.

Target looks to rebuild bridges

Target has been especially in the crosshairs since it announced a rollback of DEI programs in January. Although the company posted 1.5% growth in comparable sales for Q4, its annual growth was just 0.1%, and executives expressed hope for a stronger Easter season.

To manage the fallout, Target CEO Brian Cornell is reportedly seeking a meeting with civil rights leader Rev. Al Sharpton to discuss the companys DEI policies, according to the Associated Press.

Costco emerges a winner

While Target and Walmart face declining metrics, Costco has charted a different courseand is seeing rewards. On February 28, Costcos website traffic surged 22%, and its app traffic rose 3%. The warehouse retailer also recorded a 2.1% year-over-year rise in February foot traffic, followed by a 7.6% increase in March, per Placer.ai.

The data suggests that Costcos consistent support for DEI may be driving brand loyalty amid a politically charged shopping environment.

As federal regulators and consumers alike demand more transparency and social accountability from retailers, the battle over brand values appears to be playing out not just in press releasesbut in parking lots and browser tabs nationwide.

Sign up below for The Daily Consumer, our newsletter on the latest consumer news, including recalls, scams, lawsuits and more.

Posted: 2025-04-22 22:05:44