The Education Department had previously said it would seized old-age benefits

The U.S. Education Department has reversed course and now says it has not and will not garnish the Social Security benefits of older people whose student loans are delinquent.

The government restarted collections for the millions of people who are in default on their loans and had said its collection efforts would include garnishing Social Security payments. But now an Education Department spokesperson says that's not happening.

The department has not garnished any Social Security benefits since the post-pandemic resumption of collections and has paused any future Social Security offsets, department spokesperson Ellen Keast said last week, according to published reports.

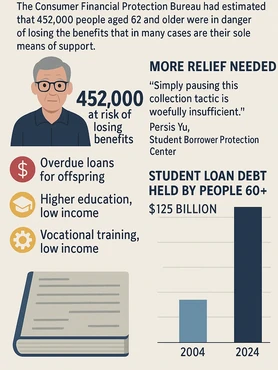

The Consumer Financial Protection Bureau had estimated that 452,000 people 62 and older were in danger of losing the benefits that in many cases are their sole means of support.

Many older people with overdue student loan debt are parents and grandparents who served as guarantors for their offspring. Others never managed to earn a comfortable living despite attaining at least a partial higher education.

Others went to trade or vocational schools whose training did not equate to well-paying jobs.

More relief needed

Advocates welcomed the news but encouraged the Trump administration to go further to provide relief for the roughly 5.3 million borrowers in default.

Simply pausing this collection tactic is woefully insufficient, said Persis Yu, executive director of the Student Borrower Protection Center. Any continued effort to restart the governments debt collection machine is cruel, unnecessary and will further fan the flames of economic chaos for working families across this country.

Yu said the on-again, off-again collections were an attempt to "act toughtough for an audience of right-wing talking heads and Republican donors, even though the government agency she runs remains profoundly broken."

Student loan debt among older people has grown at a staggering rate, in part due to rising tuition that has forced more people to borrow heavily. People 60 and olderhold an estimated $125 billion in student loan debt, according to the National Consumer Law Center, a sixfold increase from 20 years ago.

Posted: 2025-06-10 13:24:20