The tax-deferred accounts would help pay for college or other expenses

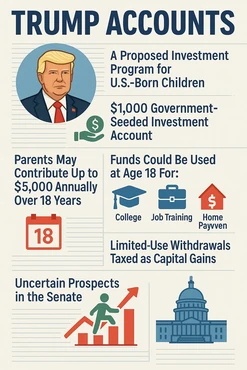

- PresidentTrump on Monday promoted "Trump accounts" that would provide every U.S.-born child with a $1,000 government-seeded investment account, allowing parents to contribute up to $5,000 annually over 18 years

- The tax-deferred accounts would track stock market performance and funds could be used at age 18 for college, job training, small business startup, or home down payments, with limited-use withdrawals taxed as capital gains

- The proposal faces uncertain prospects in the Senate, where fiscally conservative Republicans are pushing for deeper spending cuts in the broader tax and spending package that could add over $3 trillion to the national debt

PresidentTrump touted a new investment program for American children on Monday as Republicans work to advance their sweeping tax and spending legislation through the Senate.

Speaking at a White House roundtable with prominent CEOs, Trump promoted "Trump accounts" $1,000 government-seeded investment accounts that would be established for children born in the United States between January 1, 2025, and December 31, 2028, covering most of his second presidential term.

"This is a pro-family initiative that will help millions of Americans harness the strength of our economy to lift up the next generation, and they'll really be getting a big jump on life, especially if we get a little bit lucky with some of the numbers in the economies into the future," Trump said.

The tax-deferred accounts would track overall stock market performance over an 18-year period, with parents allowed to contribute up to $5,000 annually. Upon reaching age 18, account holders could withdraw funds for specific purposes: college tuition, job training programs, small business ventures, or first-home down payments. Money used for these approved purposes would be taxed as long-term capital gains, while other withdrawals would face ordinary income tax rates.

Started out as the MAGA Act

House Speaker Mike Johnson, who helped shepherd the broader tax package through the House last month, called the program "transformative policy that gives every eligible American child a financial head start from day one."

"If you have a 401(k), you understand the power of investing early for the future," Johnson said at the White House event.

The proposal originated as the "MAGA Act" Money Accounts for Growth and Advancement introduced by Rep. Blake Moore (R-Utah) in May before being incorporated into the House Republican tax bill and renamed after Trump.

Several major CEOs expressed support for the initiative during Monday's roundtable. Dell Technologies founder Michael Dell announced his company would match the government's $1,000 seed money for employees' newborn children. Goldman Sachs CEO David Solomon and Uber CEO Dara Khosrowshahi also participated in the White House event.

However, the program faces uncertain prospects as the Senate considers the broader legislation. Fiscally conservative Republicans have criticized the overall package for insufficient spending cuts and are seeking substantial revisions to the House version.

Republicans have not released official cost estimates for Trump accounts, but with approximately 3.6 million babies born annually in the United States, the program could cost more than $3 billion per year. The broader tax and spending package is projected to add over $3 trillion to the national debt over the next decade, according to Congressional Budget Office estimates.

The Trump administration's promotion of the child investment accounts comes as Democrats criticize other provisions in the Republican legislation that would reduce funding for programs including Medicaid and the Supplemental Nutrition Assistance Program. Democrats argue these cuts would harm millions of American children and families by reducing access to healthcare and nutrition benefits.

Similar to some state programs

The Trump accounts program resembles existing "baby bond" initiatives in California, Connecticut, and Washington, D.C., which provide investment accounts for some newborns. However, those local programs specifically target children from lower-income families to address wealth inequality, while Trump accounts would be available to Americans regardless of socioeconomic status.

To qualify for a Trump account, at least one parent would needa Social Security number with work authorization, potentially excluding some U.S.-born children of immigrants from the program.

Economist Darrick Hamilton, who originally conceptualized baby bonds, criticized the Republican approach, telling The Washington Post that the program would likely "enhance inequality" by "directing our public resources towards an already affluent class while at the same time, imposing mean-spirited cuts to those who need the most."

As the Senate continues deliberations on the comprehensive tax and spending legislation, the future of Trump accounts remains uncertain amid broader debates over fiscal responsibility and government spending priorities.

Posted: 2025-06-11 17:24:02