Medicaid cuts and food benefit reductions could deepen medical debt crisis and harm low-income families, advocates warn

-

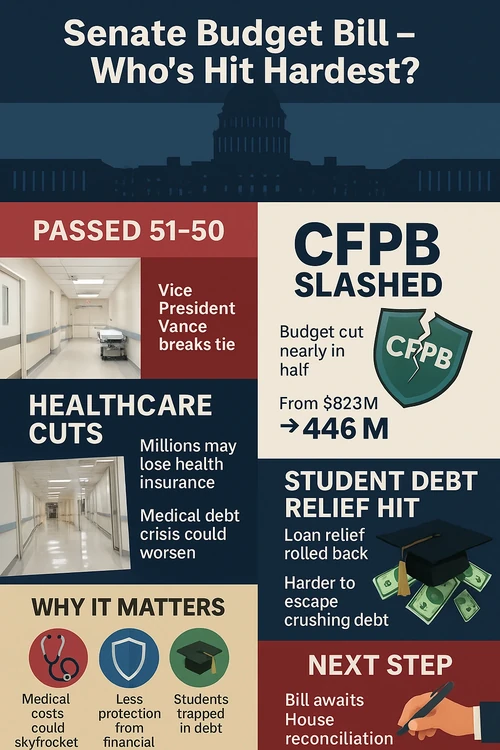

Senate passes reconciliation bill 51-50, with Vice President Vance casting tie-breaking vote, threatening healthcare, consumer protections, and student loan relief.

-

Medicaid cuts and food benefit reductions could deepen medical debt crisis and harm low-income families, advocates warn.

-

Consumer watchdog CFPB faces funding cuts of up to 70%, raising fears of unchecked financial industry abuses.

In a dramatic vote that could transform the financial and social safety net for millions of Americans, the U.S. Senate has narrowly passed its sweeping Reconciliation Bill, sending shockwaves through consumer advocacy circles and low-income communities.

The bill, which passed 51-50 with Vice President J.D. Vance casting the tie-breaking vote, is now headed back to the House, where it faces an uncertain fate.

The legislation proposes sweeping cuts across key programs, including Medicaid, food assistance, consumer financial protections, and student loan relief. Analysts warn the combined impact could push millions further into debt and strip vital protections from the nations most vulnerable.

This bill is nothing short of a disaster, said Jenifer Bosco, senior attorney at the National Consumer Law Center (NCLC). Millions of families will lose insurance coverage, leaving them to face rising medical costs without adequate coverage and pushing them into the ranks of the nearly 100 million people already buckling under the weight of medical debt. Bosco noted that medical debt hampers families ability to afford essentials like housing, food, and medicine, while exposing them to predatory debt collection practices and damaging their credit.

CFPB would be 'gutted'

One of the bills sharpest flashpoints is its gutting of the Consumer Financial Protection Bureau (CFPB). Under the Senate measure, the Bureaus funding cap would fall from 12% to 6.5% of the Federal Reserves 2009 operating expenses, adjusted for inflation. That would reduce the CFPBs budget from $823 million to about $446 million for FY2025 a level even lower than what prior Trump-appointed directors Mick Mulvaney and Kathy Kraninger deemed necessary to fulfill the agencys mission.

The Senates bill will drastically slash the Consumer Financial Protection Bureau, ending its critical work to protect ordinary people across the country, said Lauren Saunders, NCLCs associate director. There is nothing beautiful about allowing big banks, fintechs, and other financial service providers to break the law and exploit consumers including servicemembers, veterans, and their families.

The CFPB has recovered over $21 billion for around 200 million consumers since its creation, serving as a bulwark against deceptive financial practices. Advocates say crippling its budget would leave Americans more exposed to financial harm, especially as economic pressures mount.

Mike Calhoun, president of the Center for Responsible Lending, called the Senate bill a big brutal bill and warned that the proposed cuts signal an intent by this Administration and Congress to significantly abandon the federal governments obligation to protect consumers from harms in the financial marketplace.

Student loan provisions cut back

Beyond consumer protections, the bill also deals a blow to student borrowers. It sharply limits student loan forgiveness and repayment flexibility, jeopardizing relief for borrowers whose schools have closed or defrauded them. Pulling back relief options for already overburdened students is bait and switch and just plain cruel, said Kyra Taylor, NCLC staff attorney. Congress should be working to ensure student loan debt doesnt follow low-income borrowers to the grave.

The Senates vote follows the chambers failure to adopt an amendment that would have spared the CFPB from the cuts. Meanwhile, the Trump administration is reportedly pursuing even deeper reductions in the agencys budget, part of broader efforts to reshape federal oversight of financial markets.

As the bill advances toward President Trumps desk, advocates continue pressing lawmakers to reconsider the sweeping reductions. American consumers count on the Consumer Financial Protection Bureau to protect their wallets from harm, Calhoun said. Lowering the Bureaus budget ceiling by nearly half suggests that many of those consumers are likely to be let down.

Posted: 2025-07-02 16:33:22