Scheme promised 75% debt reductions but it didn't turned out that way, FTC charges

- Federal court halts Accelerated Debt scheme accused of impersonating banks and government agencies

-

Scammers allegedly promised up to 75% debt reduction but left victims deeper in debt

-

FTC seeks monetary relief for defrauded consumers, many of them elderly and retired veterans

At the request of the Federal Trade Commission, a federal court has shut down an alleged massive and deceptive debt relief operation accused of targeting seniors and veterans, including disabled and retired military personnel, through fraudulent promises and impersonation tactics.

The FTC filed a complaint against seven companies and three individuals associated with the so-called Accelerated Debt program. The defendants allegedly falsely claimed they could slash consumers' unsecured debt by up to 75%, while in reality, they charged illegal upfront fees and drove victims further into financial ruin.

The defendants falsely posed as consumers banks and credit bureaus to mislead them into paying thousands of dollars for supposed debt relief services, said Christopher Mufarrige, Director of the FTCs Bureau of Consumer Protection. What makes this case especially egregious is the defendants targeting of older Americans and veterans.

Victims include veterans and retirees

Among the victims was an Army veteran who saw his credit score plunge from the high 700s to the 500s after being advised to stop making payments on his credit cardsultimately putting his job-related security clearance at risk. Another victim, a retired, disabled veteran, was forced to drain his savings and retirement funds to pay off the new debt that accumulated under the defendants' program, which also charged him a nearly $10,000 advance fee.

A web of deception

According to the FTCs complaint, the defendants used telemarketing, online ads, and direct mail to lure consumers, and then engaged in a range of unlawful behaviors, including:

-

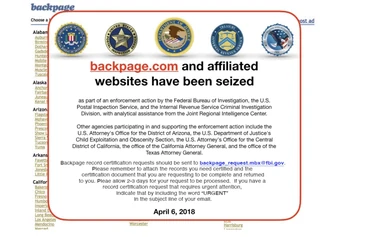

Impersonating banks, credit card companies, government agencies, and credit bureaus

-

Falsely promising to eliminate large portions of unsecured debt

-

Collecting illegal advance fees before delivering services

-

Using banned remotely created checks without permission

-

Illegally obtaining consumers' credit reports

-

Violating federal Do Not Call rules

These actions allegedly violated multiple federal laws, including the FTC Act, the Telemarketing Sales Rule, the Fair Credit Reporting Act, the Impersonation Rule, and Section 521 of the Gramm-Leach-Bliley Act, which prohibits deceptive efforts to acquire financial data.

Whos named in the lawsuit

The FTC filed the complaint in the U.S. District Court for the District of Arizona, naming the following corporate and individual defendants:

-

Accelerated Debt Settlement, Inc.

-

ADS Resolve LLC

-

Financial Solutions Group LLC

-

Unified Capital Services LLC

-

Mediawerks

-

Resolution Specialists LLC

-

Futura Capital LLC

-

Jeffery A. Lakes

-

Robert Knechtel

-

Elizabeth Reaney

Posted: 2025-07-22 18:43:29