Rate-cut expectations remain high, though odds of deeper cuts have pulled back slightly

-

Producer prices jumped in July but may not translate directly into the Feds preferred inflation gauge, easing fears of runaway inflation.

-

Jobless claims dipped, signaling resilience in the labor market despite tariff pressure.

-

Rate-cut expectations remain high, though odds of deeper cuts have pulled back slightly.

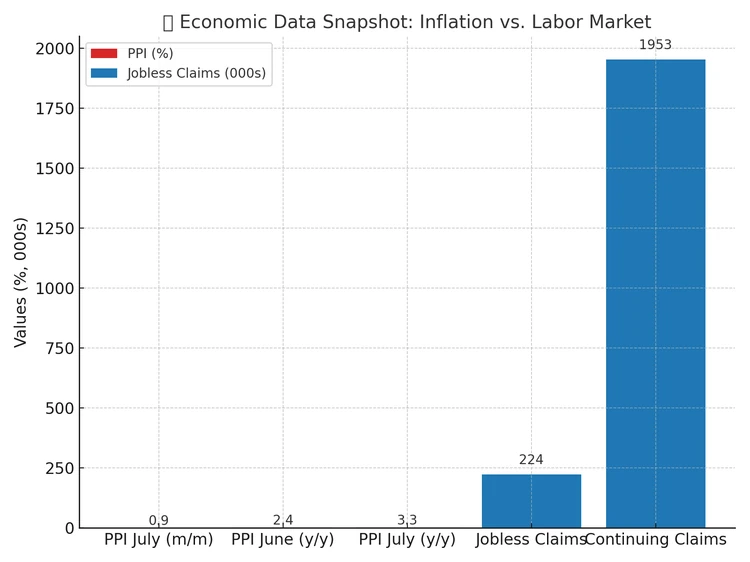

Wall Street was braced for hotter inflation data, and the latest producer price index (PPI) didnt disappoint. Prices for final demand surged 0.9% in July, far above expectations of a 0.2% increase, with annual wholesale inflation jumping to 3.3% from 2.4%. Yet markets are betting that the spike wont derail the Federal Reserves path toward interest rate cuts.

The S&P 500 fell modestly in early Thursday trading, one day after closing at a fresh record high. Among notable laggards was Deere (DE), which slumped on a tempered earnings outlook amid pressure from Trump administration tariffs.

PPI: Hotter than expected

The Bureau of Labor Statistics reported that goods prices rose 0.7% in July, the most since January, with food costs accounting for 40% of the increase. Distributor margins also jumped 2%, defying expectations that wholesalers might absorb tariff-related costs.

However, economists stressed that the PPIs surge may not flow directly into the Feds preferred inflation gauge the core personal consumption expenditures (PCE) index. Samuel Tombs of Pantheon Macroeconomics estimated Julys core PCE may rise just 0.26%, with market-based prices climbing less than 0.2%.

Labor market steady

The labor market showed continued strength. New jobless claims fell to 224,000, slightly below expectations, while continuing claims eased to 1.953 million. The dip signals that fewer Americans are relying on extended benefits as they search for new work.

Fed policy outlook

Even with hotter inflation, markets still expect the Fed to cut rates at its Sept. 17 meeting. According to CME FedWatch data, odds of a 25-basis-point cut remain near certainty, though chances of a larger 50-basis-point cut evaporated after the PPI release.

For the remainder of 2025, traders are split: markets now price in 48% odds of 75 basis points in total cuts, down from 57% earlier this week.

Why it matters

The combination of hotter wholesale inflation and steady jobless claims creates a mixed backdrop for policymakers. The Trump administration continues to push for aggressive rate cuts, but the Fed may tread more cautiously as it balances tariff-related cost pressures with the risk of economic slowdown.

For investors, that means more volatility ahead and every new data release, from CPI to PCE, will carry added weight in the countdown to Septembers Fed meeting.

Posted: 2025-08-14 14:10:51