Shrinkflation can be a sneaky way for businesses to raise the effective price of a product without consumers noticing

The price of eggs and other staples gets a lot of attention lately but a more insidious phenomenon,"shrinkflation," is also leading consumers to pay more for less, often without even noticing.

What is shrinkflation?

Shrinkflation is also known as product downsizing. It occurs when manufacturers decrease (or shrink) the quantity of an item without a corresponding price drop. Sometimes the price doesnt change at all. Sometimes the price goes down slightly, but the per-unit price (for example, the price per ounce) is still higher than before. This contributes to overall inflation.

Examples of Quantity and Price Changes for Downsized Items

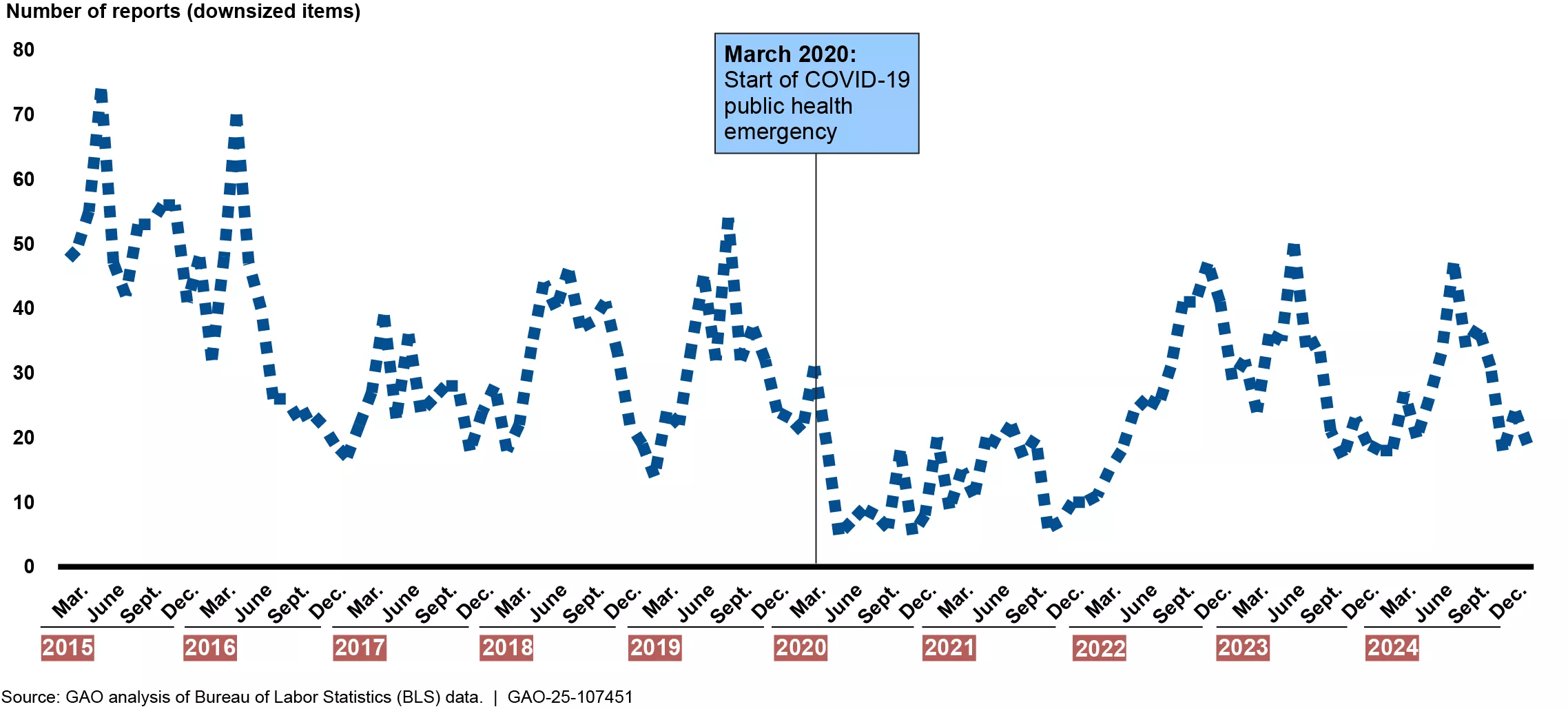

How common is shrinkflation?Product downsizing isnt new. The GAO looked at trends during the last 10 years or so, we found that downsizing occurred most frequently in 2015. And it was at its lowest in 2020 and 2021, during the first 2 years of the COVID-19 pandemic. Reports of downsized items increased starting in early 2022, amidst rising inflation.

Even so, shrinkflation had a minimal impact on overall inflation from 2019 to 2024. This is because items that were downsized made up a small percentage of goods and services tracked in inflation measures. And many goods and services, such as housing, cannot be downsized in the same way that household products can.

Reports of Downsized Items, by Month, from 2015-2024

Why it happens

Why would manufacturers downsize items?In deciding whether to downsize products, manufacturers consider factors that can affect their profits. For example, if the costs of producing items increases, then manufacturers might choose to downsize rather than raise the total price for an item. Before deciding to downsize products, manufacturers consider things like how consumers might respond to downsizing versus a price increase and how competitors might respond. They dont want to lose customers or sales.

A manufacturer may anticipate that a per-unit increase in price will have less effect on sales than simply raising the price without changing the size. Studies we reviewed found that consumers were less likely to react to downsizing than to price increases. In other words, people would still buy coffee and paper towels even after downsizing. This may be because consumers have a strong brand preference or do not notice the size or unit price change.

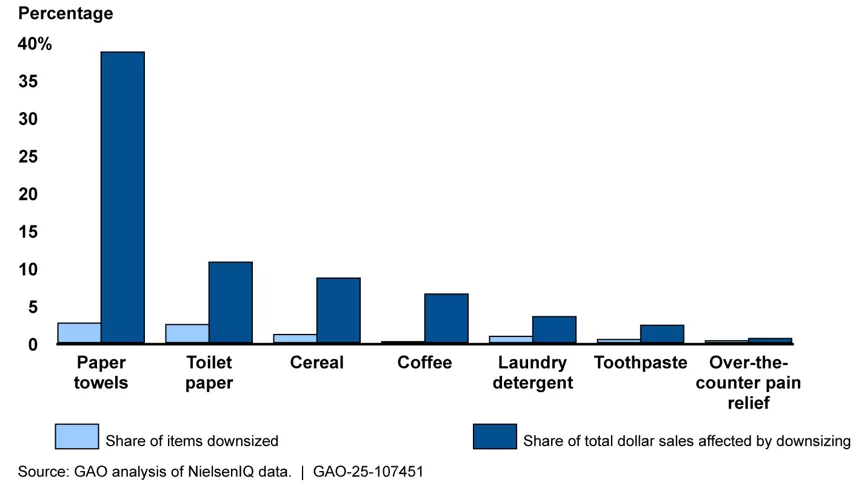

Which items were downsized the most?For the GAO'snew report, itlooked at some common household goods in seven product categories to see trends in downsizing. We found that downsizing affected a small percentage of products. It impacted less than 5% of items we looked at. Within a product category, popular items that were commonly bought by consumers were more likely to be downsized. Paper products, like paper towels and toilet paper, were among those items downsized at higher rates.

Share of Items and Sales Affected by Downsizing for Selected Product Categories, 20212023

On average, the per-unit price increase among downsized products ranged from 12% for paper towels to 32% for coffee. Those price increases could have a meaningful impact on households that continue to purchase these products regularly and at similar volumes.

What can be done to improve transparency around shrinkflation?

Downsizing is not typically disclosed on packaging, and consumers may not remember unit prices or notice small changes in sizes.

But just because they didnt notice, doesnt mean consumers shouldnt know about downsizing. And there are some policy options that could increase transparency for consumers. Each option has advantages and disadvantages. Options include:

- Requiring downsizing labels and other disclosures on packaging

- Providing more consistent unit price labeling across states to help consumers compare prices more easily

- Educating consumers about downsizing

- Prohibiting certain downsizing practices deemed unfair or deceptive

Several states are already doing some of these things. For example, more than a dozen states and territories, as well as D.C., have laws requiring the unit price be disclosed on products, as illustrated below.

Other countries are also doing some of these things. For example, France requires retailers to disclose product downsizing through in-store labels. Australia is considering ways to improve the consistency of unit price labeling to help consumers better compare prices. Todays blog highlights just some of the trends and policy options we discuss in our new report. To learn more about these trends and policy options, check out the GAO'sfull report.

Posted: 2025-08-14 13:52:02