A good credit score is no longer a shield against financial stress

-

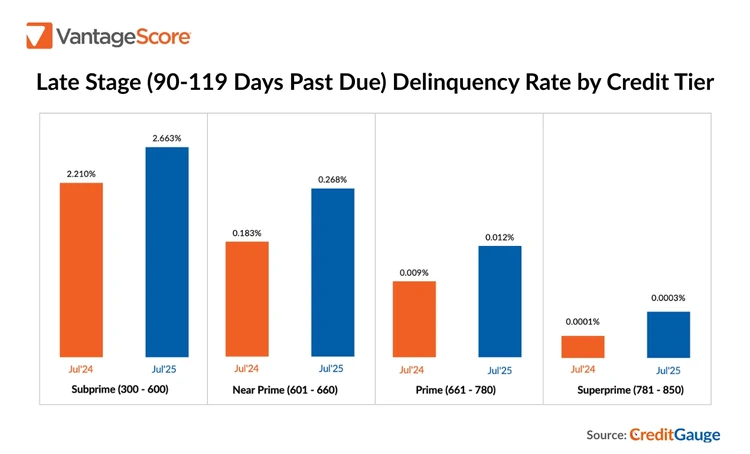

Even top credit scorers are falling behind: Late-stage delinquencies jumped 109% for Superprime borrowers and 47% for Prime borrowers.

-

Average U.S. credit score dips: The typical VantageScore 4.0 fell to 701 in July, signaling more financial stress for households.

-

Car and mortgage debt grows: Balances keep rising for auto loans and mortgages, even as fewer people are taking out new loans.

If youve always thought that people with top credit scores are nearly immune to financial trouble, new data suggest that may no longer be the case.

According to the latest CreditGauge report from VantageScore, borrowers in the highest credit tiers are now falling behind on their payments at a much faster rate than before. Superprime consumers, those with the very best credit, saw 90+ day delinquencies more than double in the past year.

Even Prime borrowers, who typically have reliable repayment histories, posted a nearly 50% increase in serious delinquencies.

The report highlights a troubling trend: credit stress is spreading up the credit ladder, catching even borrowers who usually have a strong financial footing.

The average credit score slips

Nationwide, the average VantageScore 4.0 credit score in July dipped by one point to 701. That may not sound like much, but it reflects a gradual decline in the overall health of U.S. consumers credit profiles.

More people are moving into Subprime territory, where repayment risks are higher. Subprime consumers now make up 18.7% of the population, compared to 18.1% two years ago. At the same time, the Prime tier has shrunk, signaling fewer people are able to maintain that middle-ground status.

For everyday consumers, this shift matters: falling into a lower credit tier can mean higher interest rates, tougher approval standards, and fewer options when it comes to borrowing.

Bigger loans, rising delinquencies

The report also sheds light on whats happening with two of the biggest expenses for most households: cars and homes.

-

Auto loans and mortgages are seeing higher rates of borrowers missing payments in the early stages (3059 days late).

-

Loan balances are climbing in both categories, as the sustained high cost of cars and housing keeps pushing debt loads higher.

-

At the same time, new lending is slowing. Auto loan originations fell to 1.42% in July, down from a spring peak of 1.76%. Mortgage originations were essentially flat compared to June, but only slightly higher than a year ago.

Susan Fahy, EVP and Chief Digital Officer at VantageScore, put it bluntly: Sustained inflation for car and house prices is driving higher balances in these credit categories.

That means even if fewer people are buying new cars or homes, those who do are often borrowing moreand then finding it harder to keep up with payments.

If youre already carrying higher balances, its a good time to check your budget, revisit your repayment strategy, and avoid stretching too far on big purchases.

Even consumers with excellent credit may want to brace for tougher lending standards and higher borrowing costs. Banks and lenders tend to tighten requirements when they see delinquency trends risingmeaning it could be harder to qualify for loans or to refinance existing debt in the months ahead.

Posted: 2025-08-26 11:42:51