175,000 more homes wee underwater in the latest report

-

Cotality report shows average U.S. homeowner holds $307,000 in equity

-

National equity fell by $141.5 billion year over year, with 175,000 more homes underwater

-

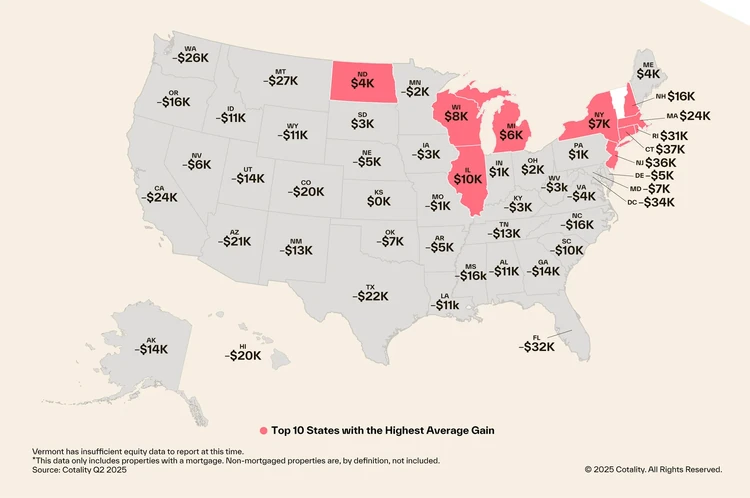

Northeast homeowners see gains while Florida, D.C., and Montana face steepest losses

Homeowner equity gains have slowed across the United States, with more borrowers falling into negative equity as home price growth stalls, according to a new report from property analytics firm Cotality.

The Homeowner Equity Report for the second quarter of 2025 shows the average U.S. borrower with a mortgage holds about $307,000 in equity still the third highest figure in history. Thats up $124,000 compared with the start of the pandemic in 2020. But overall borrower equity slipped by $141.5 billion, or 0.8%, year over year, bringing total U.S. net equity to $17.5 trillion.

Home prices this year have experienced the slowest rate of growth since the Great Financial Crisis of 2008, said Cotality Chief Economist Dr. Selma Hepp. As appreciation remains modest and even declines in some markets, home equity accumulation is projected to follow suit.

Year over year, homeowners lost an average of $9,200 in equity, the report found. That pushed the share of mortgaged homes in negative equity from 1.7% to 2%, representing 175,000 more households underwater. Still, compared with the first quarter of 2025, negative equity actually dropped by 3.3% thanks to seasonal spring price increases.

What's next?

The outlook remains mixed: 144,000 homes could regain equity if prices rise 5%, while 242,000 could fall underwater if prices decline 5%. Cotalitys forecast calls for a more modest 3% increase in home prices by June 2026.

Regional patterns are stark. Homeowners in the Northeast continue to see gains, led by Connecticut ($37,400), New Jersey ($36,200), and Rhode Island ($31,200). By contrast, 32 states posted losses, with the biggest drops in the District of Columbia ($-34,400), Florida ($-32,100), and Montana ($-26,900).

Metro-level data shows Las Vegas, Los Angeles, and San Francisco are among the least affected markets. In contrast, areas such as McAllen, Texas; Shreveport, Louisiana; and Cape Coral and Ocala, Florida have seen sharp increases in negative equity, partly due to falling home prices and the impact of natural disasters.

The next Homeowner Equity Report is scheduled for release December 11, 2025.

What it means for homeowners

-

Equity cushion shrinking: Many borrowers still hold significant equity, but year-over-year declines show that safety net is narrowing in some markets.

-

Risk of going underwater: With more homes slipping into negative equity, homeowners planning to sell or refinance may face challenges if prices soften further.

-

Regional divide: Northeastern states continue to deliver strong equity gains, while parts of Florida and the Mountain West are seeing steep losses.

Negative equity explained

What it is:

Negative equity, often called being underwater, happens when a home is worth less than the balance owed on its mortgage. For example, if a home is valued at $250,000 but the owner still owes $270,000, that homeowner is $20,000 underwater.

Why it matters:

-

Limits refinancing options, since lenders may be unwilling to approve new loans on an overvalued property

-

Makes it harder to sell a home without taking a loss

-

Can trap homeowners in place if they need to move for work or family reasons

What homeowners can do:

-

Stay put: Negative equity isnt always a problem if you plan to stay in your home and keep making payments

-

Watch the market: Modest home price gains can restore equity over time

-

Avoid risky loans: Be cautious with cash-out refinances or home equity loans if values are falling

-

Seek help if needed: Programs from lenders or government agencies may offer relief for underwater borrowers in hardship situations

The bottom line:

Negative equity levels remain relatively low by historic standards, but increases in certain regions highlight risks if home prices dip further.

Posted: 2025-09-12 19:11:13