Holiday deals come with new financial risks

Consumers facing high costs may be tempted by buy now, pay later (BNPL) and deferred-interest credit card offers

Advocates say both products can mask significant fees and steep retroactive interest charges

Experts urge shoppers to proceed cautiously and avoid promotions that seem too good to be true

As the holiday shopping season ramps up during what advocates call an ongoing affordability crisis, consumer experts are urging shoppers to think twice before accepting promotions that promise painless financing. The National Consumer Law Center (NCLC) warns that both buy now, pay later (BNPL) plans and so-called no interest credit card promotions can trap people in costly debt at a time when household obligations are already at historic highs.

Buy now, pay later loans can make unaffordable purchases look cheaper than they are, and zero-interest credit card promotions can be a risky hidden time bomb, said Lauren Saunders, associate director at NCLC, in a news release.

Despite their appeal, these products often come with fine-print pitfalls and, according to the group, a weakened regulatory environment is leaving consumers more exposed than in past years. With the Consumer Financial Protection Bureau (CFPB) pulling back from aggressive oversight, advocates say its more important than ever for shoppers to protect themselves.

BNPL loans can mask high fees and repayment issues

BNPL services are marketed as an interest-free way to stretch out payments, but NCLC warns that lenders often charge late fees, bounced-payment fees and other add-ons that can quickly raise the true cost of a purchase. Consumers have also reported trouble cancelling BNPL loans when orders are returned or cancelled a problem that has left some paying off financing for items they never kept.

Managing several BNPL plans at once can be equally hazardous. With different due dates across multiple providers, shoppers may inadvertently trigger overdraft or nonsufficient-fund fees, compounding their financial strain.

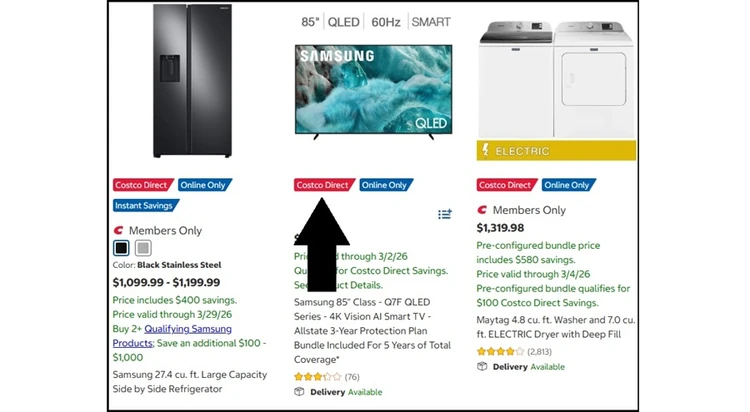

Deferred-interest credit cards can deliver steep retroactive charges

Deferred-interest credit card promotions may be even more dangerous. Ads commonly promise no interest for 12 months or 0% until 2026, but the catch is buried deep: if the entire balance isnt paid off before the promotional period ends, the lender retroactively charges interest on the full purchase amount going all the way back to the original transaction date.

NCLC offers a stark example: a shopper who buys a $2,500 laptop under a one-year deferred-interest plan at 31% APR and pays down everything except $100 by the deadline would still be hit with roughly $430 in back-dated interest on the entire purchase.

Dont let deceptive financial promotions with huge, delayed charges ruin your holidays, said NCLC senior attorney Chi Chi Wu. If an offer looks too good to be true, it probably is. Dont let predatory lenders put you on the hook for this years holiday spending into next year and beyond.

Tips for safer holiday financing

For shoppers considering BNPL:

-

Consider skipping purchases you cannot pay off immediately

-

Review all fees and be cautious about BNPL-linked subscriptions

-

Track payment dates closely and avoid juggling multiple BNPL plans

-

Monitor total BNPL debt and know your right to cancel automatic payments

For those weighing interest-free credit card deals:

-

Avoid deferred-interest promotions altogether

-

Dont stack multiple deferred-interest purchases on one account

-

Pay more than the minimum payment each month to reduce risk

Posted: 2025-11-24 21:44:22