Florida rental markets cooling, Midwest stays warm

-

U.S. single-family rents rose 0.9% year over year in October 2025, down sharply from a 2.8% increase a year earlier

-

Forty of the 50 largest metros posted slower annual rent growth, with 18 seeing outright declines

-

Florida markets continue to cool, while Midwest metros show greater resilience

Single-family rent growth slowed significantly in October as the national market continued a multiyear cooling trend, according to new data from Cotality.

The companys latest Single-Family Rent Index, based on October 2025 data, shows rents rising 0.9% year over year less than one-third of the increase recorded during the same period last year. While rents are still climbing nationally, the pace of growth has eased across most major metropolitan areas.

Forty of the largest 50 metros posted lower annual rent growth compared to October 2024, said Molly Boesel, senior principal economist at Cotality. Eighteen metros saw outright year-over-year declines in the Single-Family Rent Index, with half of those declines occurring in Florida.

Rent growth moderates but remains elevated

Despite the slowdown, Cotality said rent levels remain well above pre-pandemic norms. Annual rent growth peaked in March 2022, and while increases have decelerated for more than three years, the national index in October was still about 9% higher than the 2022 average.

Boesel described the trend as a normalization rather than a reversal, noting that affordability pressures and regional market differences continue to influence rent performance.

Florida cools as Midwest holds steady

Regional differences are becoming more pronounced as the market adjusts. Several Florida metros, including Cape Coral and North Port, posted two consecutive years of annual rent declines, signaling a correction after rapid growth earlier in the decade.

In contrast, Midwest markets such as Chicago and Detroit continue to show comparatively strong rent growth, reflecting steadier demand and more balanced supply conditions.

High-end rentals outpace lower-end growth

Rent growth slowed across price segments, though lower-end properties saw a sharper deceleration.

High-end single-family rents rose 1.4% year over year in October, down from a 3.3% increase in October 2024. Low-end rents increased just 0.4%, compared with a 2.7% gain a year earlier.

Cotality said the divergence suggests affordability challenges are weighing more heavily on budget-conscious renters, while demand for higher-priced rentals remains more resilient, even as growth moderates.

Detached rentals trail attached properties

Rent growth also varied by property type. Detached single-family rentals posted a 0.8% annual increase in October, while rents for attached rentals rose 1% year over year.

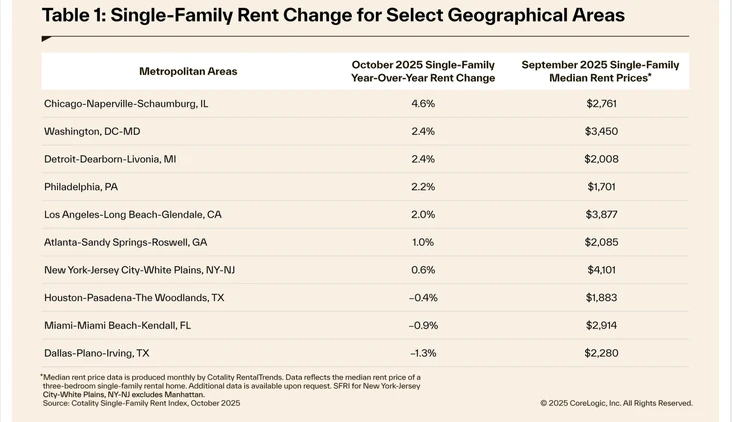

Chicago leads large metros as Dallas declines

Among the nations 10 largest metropolitan areas, Chicago recorded the highest rent growth at 4.6% in October. Washington, D.C., and Detroit followed at 2.4% each, with Philadelphia (2.2%) and Los Angeles (0.6%) rounding out the top five.

Dallas continued to post the weakest performance among major metros, with rents declining 1.3% year over year.

Cotality said its next Single-Family Rent Index report, featuring November 2025 data, will be released on January 15. More housing market insights are available on the companys Cotality Insights blog.

Posted: 2025-12-22 01:56:49