RSS

RSS

Article Tools/Herramientas de artículos

+ Larger Font/Fuente más grande | - Smaller Font/Fuente más pequeñaConsumer Daily Reports

Trusted reliable news sources from around the web. We offer special news reports, topic news videos, and related content stories. Truly a birds eye view on news.

- Details

- Written by Consumer Affairs News

- Category: Consumer Daily Reports

Danone issues nationwide recall after finding hard plastic in popular yogurt toppings

-

Select YoCrunch yogurt products are being recalled due to potential plastic pieces in the topping dome, which can be a choking hazard.

-

The recall affects multiple flavors sold across the U.S., including Oreo, M&Ms, and Nestl Crunch.

-

Consumers are urged not to eat the affected products and can request a refund or replacement.

YoCrunch yogurt fansheres an important heads-up: Danone North America, the company behind YoCrunch yogurts, has voluntarily recalled several popular products because the dome-shaped toppers may contain small, hard plastic pieces.

The recall, announced by the U.S. Food and Drug Administration (FDA), includes a variety of YoCrunch yogurt cups with mix-in toppings like M&Ms, Oreo cookie pieces, and Nestl Crunch bits. These products were distributed nationwide and could still be sitting in your fridge.

Whats going on?

Danone says the issue was traced back to a third-party supplier that provides the dome-shaped toppers used for the crunchy toppings. Some of those toppers may include pieces of plastic that could pose a choking hazard or cause injury if consumed. While no injuries or illnesses have been reported so far, the company issued the recall out of an abundance of caution.

This is not a contamination issue with the yogurt itself just the plastic dome that holds the toppings. Still, if you have any of the affected products, its best not to eat them.

Which YoCrunch products are affected?

The recall includes the following six-ounce multipack and single-serve yogurt varieties:

-

YoCrunch Oreo 6oz 4-pack

-

YoCrunch M&Ms 6oz 4-pack

-

YoCrunch Nestl Crunch 6oz 4-pack

-

YoCrunch M&Ms Vanilla Lowfat Yogurt 6oz

-

YoCrunch Oreo Vanilla Lowfat Yogurt 6oz

-

YoCrunch Nestl Crunch Vanilla Lowfat Yogurt 6oz

For a full list of the UPCs and expiration dates, you can visit the official recall page on YoCrunch.com or FDA.gov.

What should you do if you have one?

If you have one of the recalled YoCrunch yogurts, Danone asks that you not eat it. Instead, take a photo of the products UPC and expiration date, then discard the yogurt. You can use that information to request a refund or replacement through YoCrunchs website or by calling their toll-free number listed on the recall notice.

If youve already eaten one and feel fine, theres no need to panic again, there have been no reports of injury. But if you experience anything unusual, it's always smart to consult a health care provider.

A quick reminder

YoCrunch says it takes product safety seriously and is working closely with retailers and the FDA to remove affected items from shelves. The company also emphasized that this issue was limited to specific lots and that their other products are not affected.

- Details

- Written by Consumer Affairs News

- Category: Consumer Daily Reports

Nutritionists wants to call out sugar, sodium, fats more clearly

- Coalition Urges Stronger FDA Front-of-Package Labels on Sugars, Sodium, Fats

-

28 consumer and health groups plus 12 researchers back mandatory nutrition labels

-

Advocate simpler High In warnings and sweetener disclosures

-

Industry expected to push back in favor of voluntary labeling

A broad coalition of 28 leading consumer, public health, and nutrition organizations, alongside 12 academic researchers, has called on the U.S. Food and Drug Administration (FDA) to adopt a strong and simplified front-of-package nutrition labeling system that clearly alerts consumers when foods are high in added sugars, sodium, or saturated fat.

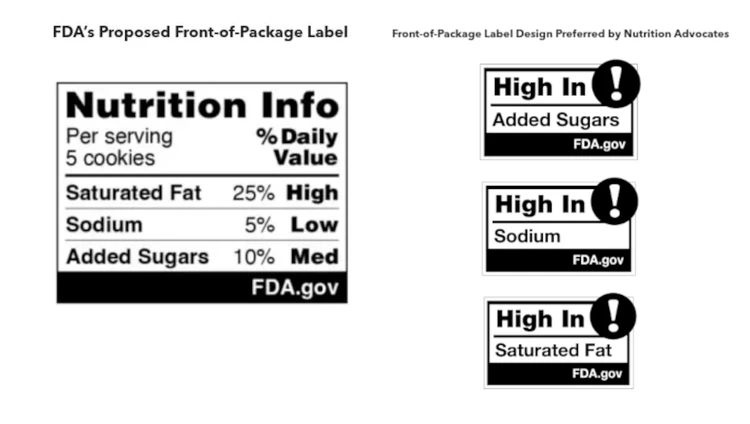

The joint comments, submitted this week, respond to the FDAs January 2025 proposed rule requiring prominent front-of-package labels to classify packaged foods as high, medium, or low in key nutrients of concern.

The rule would apply to products marketed to adults and children aged four years and older and was advanced under the Biden administration. It now awaits potential finalization under the Trump administration, which has not yet released its regulatory agenda but has signaled that nutrition labeling remains a priority.

While endorsing the FDAs push for mandatory, interpretive labels, the coalitionincluding the Center for Science in the Public Interest (CSPI)urged regulators to go further. They recommended using simpler, attention-grabbing icons, such as an exclamation mark, to quickly communicate health risks posed by excessive added sugars, sodium, or saturated fats.

"It's time to act"

Front-of-package labeling is one of the most impactful approaches we have to address overconsumption of harmful ultra-processed foods and improve our nations health, said CSPI senior policy scientist Eva Greenthal. Its time to act on evidence-based solutions.

The groups also pressed the FDA to require front-of-package disclosures for products containing non-nutritive sweeteners, especially since these calorie-free additives are not recommended for children. Such disclosures, they argued, would help deter manufacturers from reformulating products with these ingredients as a workaround to avoid high in labels. The original Biden-era proposal did not address this issue.

Additional recommendations included extending front-of-package labeling requirements to foods intended for infants and toddlers and pairing the new rules with robust public education to ensure consumers understand and use the labels effectively.

Despite the coalitions support, the FDAs proposal faces likely resistance from the food and beverage industry, which has long favored a voluntary Facts Up Front labeling system. Studies show the voluntary labels fail to help consumers quickly identify foods high in unhealthy nutrients, while High In-style warnings have been proven to influence healthier purchasing decisions, encourage product reformulation, and reduce deaths linked to diet-related diseases.

CSPI also submitted separate comments detailing further steps the agency could take to maximize the rules impact on public health.

FDA officials have not yet set a timeline for issuing a final rule.

- Details

- Written by Consumer Affairs News

- Category: Consumer Daily Reports

Company to pay $9 million in refunds and penalties

- FirstCash to pay $9 million in refunds and penalties for illegal pawn loans to servicemembers

-

CFPB lawsuit alleged loans exceeded 36% APR cap and imposed illegal arbitration terms

-

Settlement mandates compliance reforms and restitution for affected military families

The Consumer Financial Protection Bureau (CFPB) has reached a settlement with FirstCash, Inc., and its nineteen subsidiaries over allegations that the company violated the Military Lending Act (MLA) by issuing high-interest pawn loans to active duty servicemembers and their families.

The parties jointly filed a stipulated final judgment and proposed order to resolve the CFPBs November 2021 lawsuit, which isawaiting court approval.

FirstCash, a Delaware-based nonbank corporation headquartered in Fort Worth, Texas, operates more than 1,000 pawnshops across the United States through its wholly owned subsidiaries. The CFPB alleged that since at least October 3, 2016, FirstCash and its subsidiaries charged borrowers covered under the MLA annual percentage rates exceeding the legal 36% cap.

Additionally, the agency claimed that FirstCashs loan agreements unlawfully required arbitration clauses and failed to provide mandatory loan disclosures, further violating protections granted under the MLA.

The alleged misconduct also constituted violations of a 2013 CFPB order against a predecessor entity of FirstCash, heightening regulatory concerns over the companys lending practices.

Servicemembers to be compensated

Under the proposed settlement terms, FirstCash would be required to set aside $5 million to compensate harmed servicemembers and their dependents for thousands of unlawful pawn loans.

The company must also pay a $4 million civil penalty to the CFPBs victims relief fund. Beyond financial penalties, FirstCash is obligated to ensure strict compliance with the MLA going forward, either by offering MLA-compliant loan products or implementing regulatory safeguards to prevent lending to protected military borrowers where prohibited.

The CFPB said the settlement underscores its commitment to protecting military families from predatory lending practices. The proposed order awaits final approval from the court.

- Details

- Written by Consumer Affairs News

- Category: Consumer Daily Reports

Company to pay $150,000 in penalties

- Telehealth firm NextMed accused of hiding costs and faking positive reviews

-

FTC alleges misleading weight-loss promises and undisclosed one-year contracts

-

$150,000 settlement to fund refunds; new rules imposed on business practices

The operators of Southern Health Solutions, Inc., doing business as Next Medical and NextMed, have agreed to settle Federal Trade Commission charges that they misled consumers with deceptive weight-loss claims, hidden fees, and fabricated reviews to promote their telemedicine weight-loss programs.

According to the FTCs complaint, New York-based NextMed, along with its founders Robert Epstein and CEO Frank Leonardo III, marketed membership programs starting in early 2022 that offered consumers access to medical providers who could prescribe popular glucagon-like peptide 1 (GLP-1) drugs like Wegovy and Ozempic.

However, while the programs were advertised at monthly rates of $138 or $188, the company failed to disclose that these fees did not cover the actual cost of the weight-loss drugs, lab work required for eligibility, or mandatory medical consultations to obtain prescriptions.

Beyond hidden costs, the FTC alleged that NextMed locked customers into undisclosed 12-month contracts with costly early termination fees and made it difficult for consumers to cancel or secure refunds due to inadequate customer service staffing.

The company also reportedly manipulated online reputation platforms by suppressing negative reviews, offering Amazon gift cards to consumers in exchange for deleting critical comments, and fabricating positive testimonials and before-and-after photos featuring individuals who had never used NextMeds services.

Consumers who signed up for NextMeds programs faced significant unexpected costs and the companys customer service failures prevented consumers from cancelling or getting a refund, said Christopher Mufarrige, Director of the FTCs Bureau of Consumer Protection. Todays action makes clear that companies cannot hide important information from consumers or neglect their responsibility to respond to valid complaints and concerns.

$150,000 for consumer refunds

Under the proposed settlement, NextMed and its principals must pay $150,000, which the FTC intends to use for consumer refunds. The agreement also imposes sweeping prohibitions and requirements on the company, including:

-

Banning misrepresentations about telehealth costs, services included, billing practices, and refund or cancellation policies.

-

Requiring credible evidence for claims about weight-loss outcomes.

-

Prohibiting the use of fake testimonials or reviews, and mandating disclosure of any unexpected ties between the company and reviewers.

-

Forbidding manipulation of online reviews, including offering incentives to remove negative feedback or falsely disputing critical reviews.

-

Mandating clear disclosure of key terms before payment, obtaining informed consent for billing, and promptly honoring valid cancellation or refund requests.

- Details

- Written by Consumer Affairs News

- Category: Consumer Daily Reports

Tax agency says it won't enforce ban on political speech by religious groups

In a proposed legal settlement, the Internal Revenue Service has agreed that it will abandon enforcement of longstanding restrictions on religious organizations' political activities, which it says it hasn't been enforcing anyway.

Once the settlement of a lawsuit is accepted by the court, churches will be able to freely discuss political campaigns and candidates during worship services without risking their tax-exempt status, the agency said. The settlement stems from a 2024 lawsuit by the National Religious Broadcasters and other religious organizations.

Rather than defend the bipartisan Johnson Amendment enacted71 years ago the IRS accepted arguments that religious organizations should have the same rights as other groups that are not tax-exempt.

Nonprofits said in a Bloomberg News reportthat the decision"could open the floodgates for political operatives to funnel money to their preferred candidates while receiving generous tax breaks at the expense of taxpayers who may not share those views."

The Johnson Amendment

The Johnson Amendment has been around since 1954, when a youngish Sen. Lyndon B. Johnson (D-Texas) offered an amendment to the tax code prohibiting not-for-profit 501(c)(3) organizations, which includes charities and churches, from engaging in any political campaign activity.

Even as evangelicals have become a massive force in politics in recent decades, Congress has left the Johnson Amendment alone and has, in fact, strengthened it. In 1987, it amended the language to clarify that the prohibition also applies to statements opposing candidates.

A pastor cant tell his flock that Jesus hates Trumps opponent, for example.

As currently written, the law prohibits political campaign activity by charities and churches by defining a 501(c)(3) organization as one "which does not participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of (or in opposition to) any candidate for public office."

But now the IRS says it has been systematically failing to enforce these crucial protections anyway. Former IRS communications officer Terry Lemons's dismissive comment that "the reality is the IRS hasn't taken much action in this area" isn't a defense.

A last-minute objection

The proposed consent decree is still awaiting approval from U.S. District Court J. Campbell Barker, a process that Citizens United for the Separation of Church and State (AU)hopes to derail.

The Trump administrations radical reinterpretation of the Johnson Amendment is a flagrant, self-serving attack on church-state separation that threatens our democracy by favoring houses of worship over other nonprofits and inserting them into partisan politics, said AU President and CEO Rachel Laser.

President Trump and his Christian Nationalist allies are once again exploiting religion to boost their own political power. Were intervening in this case so we can urge the court to reject the administrations latest gambit to re-write the law.

Some religious leaders called the action "a major step forward in restoring religious freedom in America."

Richard Harris, executive director ofTruth & Liberty, said the Johnson Amendment "has been used to silence pastors from fulfilling their God-given and historic duty to speak the truth on all issues of life.

"The pullback by the IRS implicitly recognizes that historical role of the church. It should be celebrated as an appropriate, albeit long overdue and incomplete, step toward the restoration of Constitutional freedom of religion," he said.

- Details

- Written by Consumer Affairs News

- Category: Consumer Daily Reports

The Consumer Price Index rose 0.3% from May

-

Electricity costs rose 1.0% in June and 5.8% over the past year

-

Nonalcoholic beverages jumped 1.4% in June, with coffee prices up 2.2%

-

Household furnishings and operations increased 1.0% in June

Inflation ticked higher again in June as American consumers faced higher costs in several everyday categories. The Consumer Price Index rose 0.3% on a seasonally adjusted basis, following a 0.1% increase in May. Over the past 12 months, prices have climbed 2.7% before seasonal adjustment.

Electricity and beverage costs drive the index higher

Among the categories showing the most significant monthly increases in June, electricity stood out, with a 1% increase, matching the rise in May. This continued surge contributed to a 5.8% annual increase in electricity costs, adding pressure to household budgets already strained by other rising expenses.

Food costs also saw a monthly increase of 0.3%, matching Mays pace. Within this category, nonalcoholic beverages jumped 1.4%, driven primarily by a 2.2% spike in coffee prices. Citrus fruits added to the food inflation story, rising 2.3% for the month.

Another major contributor to the June inflation was the household furnishings and operations index, which increased 1%, accelerating from Mays 0.3% rise. The broader shelter index, while rising a more modest 0.2%, remained the single largest contributor to the overall CPI increase, as housing remains a dominant component of household expenses.

Energy rebounds

Energy prices, which fell in May, reversed course in June with a 0.9% increase. Gasoline prices rose 1% for the month, although they remain down 8.3% over the past year. Natural gas prices also ticked up 0.5%, and electricitys steady rise continued.

Despite the monthly bump, the overall energy index is still 0.8% lower than a year ago, with sharp declines in gasoline and fuel oil over that period.

Other areas showing upward movement in June included:

-

Medical care services, up 0.6%

-

Apparel, up 0.4

-

Recreation, also up 0.4%

-

Personal care, up 0.3%

The core CPI, which excludes the volatile food and energy categories, rose 0.2% in June, consistent with its moderate pace in recent months.

Price declines

Offsetting some of the price increases were declines in key discretionary categories:

-

Used cars and trucks, down 0.7%

-

New vehicles, down 0.3%

-

Airline fares, down 0.1%

These declines suggest softening demand or improving supply chains in the transportation sector, offering consumers some relief in travel and automotive expenses.

Related Product Search/Búsqueda de productos relacionados