Trump's 'one big bill' provides some tax relief for older middle-class taxpayers

- Lots of changes in store for Social Security recipients as more people rely on a system that's operating above capacity.

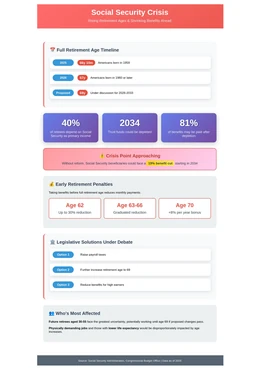

- Full retirement age (FRA) will increase to 66 years and 10 months next year for Americans born in 1959.

-

The FRA reaches 67 in 2026 for those born in 1960 or later, capping decades of gradual changes.

This is shaping up as a year for older taxpayers to remember. Besides the changes mandated by President Trump's "big beautiful bill," many Americans are facing achangein Social Security's full retirement age (FRA) that will have a big impact on their retirement planning.

Any change to Social Security creates anxiety as the program has come to be a primary source of retirement income for as many as 40% of retired Americans. This is largelydue to the disappearance of pensions from the corporate workplace and to the low savings rate by U.S. consumers and is putting a massive strain on Social Security, which was originally designed to replace about 40% of a workers pre-retirement income.

For generations, Congress has passed the buck on finding new sources of revenue for the program, leaving the Social Security Administration to stretch its resources by upping the age at which it pays full benefits.

The latest increase will come in November 2025, when the FRA the age at which individuals are eligible to receive 100% of their Social Security benefits will increase to 66 years and 10 months for those born in 1959.

This is the latest step in a gradual schedule set in motion by the 1983 amendments to the Social Security Act, aimed at reflecting longer life expectancies and reducing the financial strain on the program.

By 2026, the FRA will reach 67 for Americans born in 1960 or later a threshold that will mark the culmination of the decades-long shift. The retirement age was fixed at 65 for decades prior to these reforms.

What's a tax break and what isn't?

You may not like the FRA change but it's at least easy to understand. That's not the case, however, with taxation provisions in Trump's bill. You may recall that Trumphad promised to eliminate federal taxes on Social Security benefits. That didn't happen, although his bill does include a temporary increase to the standard deduction for older people, which might lower the taxable income for some recipients.

Here's a summary of the changes. Read carefully, it's complicated.

- Enhanced Tax Deduction:The bill includes a provision to temporarily raise the standard tax deduction for individuals aged 65 and older. The Senate version would increase the standard deduction byup to $6,000 for tax years 2025 through 2028.

- Income Limits for the Deduction:The full $6,000 deduction is available to individuals with up to$75,000 in modified adjusted gross incomeand married couples filing jointly withup to $150,000. The deduction phases out for those above these thresholds and will not benefit the wealthiest seniors.

- Impact on Taxable Social Security:This enhanced deduction can indirectly help lower or middle-income retirees by potentially shielding more of their Social Security benefits from federal taxes. Some sources state that the majority of older adults receiving Social Security will pay no federal income tax on their benefits due to this change.

- Does NOT Eliminate Social Security Taxes:Despite campaign promises and claims from the Trump administration and SSA, the billdoes not fully eliminate taxes on Social Security benefits. Policy experts have clarified that the bill provides tax relief through a deduction, not a repeal of the tax.

- Limited Scope and Exclusions:The enhanced deduction istemporary, lasting through 2028. Additionally, not all Social Security beneficiaries will benefit, including those under 65, and those with higher incomes exceeding the phase-out limits.

Early retirement getsexpensive

Returning to the FRA, although Americans can still claim benefits as early as age 62, doing so comes with significant consequences: monthly payments can be reduced by as much as 30% for those who claim early. On the other hand, delaying benefits past ones FRA can result in a higher payout, increasing by up to 8% per year until benefits max out at age 70.

The changes come as Social Security faces growing financial pressures. Recent projections indicate the programs trust funds could be depleted by 2034, potentially forcing benefit cuts unless Congress takes action. Without reforms, beneficiaries might receive only 81% of promised benefits after that date, according to estimates.

Lawmakers are debating potential solutions, ranging from raising payroll taxes to further increasing the retirement age. Some proposals under consideration could push the FRA as high as 69 between 2026 and 2033 a move that would impact millions of workers currently aged between 30 and 55.

Proponents argue such changes are necessary to keep the system solvent without directly cutting benefits, while critics warn that delaying retirement disproportionately affects those in physically demanding jobs or with lower life expectancy.

For individuals hoping to plan ahead, the Social Security Administration offers a retirement age calculator and personalized benefit estimates through its My Social Security accounts, allowing Americans to model how these changes could impact their financial futures.

While the FRA increase in 2025 is certain, the debate over further hikes is likely to remain front and center in Washington as lawmakers grapple with how to protect one of the nations most vital social safety nets for decades to come.

Posted: 2025-07-05 19:37:23