Tariffs and supply constraints are leading to higher prices

- Average monthly new vehicle sales jumped to 1.17 million in Q2 2025, driven by pull-ahead purchases

- Vehicle inventory fell below 3 million units as consumers rushed to buy ahead of tariff-related price hikes

- Rising prices and depleted supply could stall automotive momentum in Q3, Cloud Theory warns

Lots of consumers purchased new cars in the second quarter of 2025, just ahead of tariffs that affect nearly all makes and models sold in the U.S. While these savvy consumers avoided paying higher prices, they significantly drew down inventories, so that there are now fewer new cars on dealers lots, and those cars are more expensive.

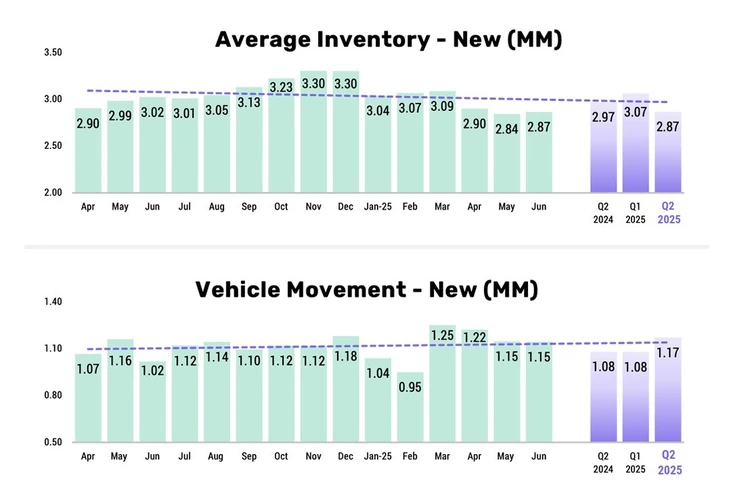

An analysis by automotive data analytics firm Cloud Theory shows the U.S. automotive industry posted a robust second quarter in 2025, buoyed by a surge in new vehicle sales that averaged 1.17 million units per month, up from 1.08 million in Q1.

However, the analysis suggests this second quarter boost may come at a cost, with signs pointing toward a challenging third quarter as inventory tightens and prices edge upward.

The second quarter figures are detailed in Cloud Theory's newly released "On the Horizon" report, which attributes the sales lift to "pull-ahead" demand. This phenomenon, triggered by tariff-related pricing concerns, began in March and continued throughout the quarter, prompting consumers to expedite purchases in anticipation of costlier vehicles.

The pull-ahead effect of tariff-related pricing increases that began in March extended into Q2, but the aftereffects of those accelerated purchases are looming, said Rick Wainschel, vice president of Data Science and Analytics at Cloud Theory. This summer poses significant risks to the industrys current momentum.

Inventory levels fall below 3 million units

This fast pace of sales has outstripped replenishment efforts, with inventory dropping steadily over the past two quarters. After averaging 3.27 million units in Q4 2024, the analysis shows inventory fell to 3.07 million in Q1 and 2.84 million in Q2 2025, marking two consecutive quarters where more vehicles left lots than were replaced.

Cloud Theory estimates that 500,000 vehicles sold over the last four months were pull-ahead purchases, significantly impacting current supply levels.

As inventory shrinks, prices are rising. The average new vehicle price climbed from $49,236 in Q1 2025 to $49,713 in Q2, a $477 increase. However, the report notes this modest gain obscures a sharper underlying rise.

To mitigate sticker shock, manufacturers have shifted production toward lower-priced segments, including midsize and small SUVs, and away from costlier full size trucks and XL SUVs.

This strategic realignment has produced a short-term dip in the Average Marketed Price by $202 in late June. Without the shift in segment mix, prices would have risen by $223, signaling broader inflationary trends.

Consumer incentives

Additional insights from the Q2 report reveal shifting market dynamics:

-

Turn ratesthe percentage of inventory sold in a given periodexceeded 40%, up from the low-to-mid 30s in previous quarters.

-

Days-to-move, a measure of how long vehicles stay on lots, dropped from 80 days in Q1 to 71 days in Q2, reflecting faster sell-through.

-

Market adjustments, or consumer-visible discounts and incentives, averaged over $2,000 in Q2up nearly $600 year-over-year.

Posted: 2025-07-10 13:32:56