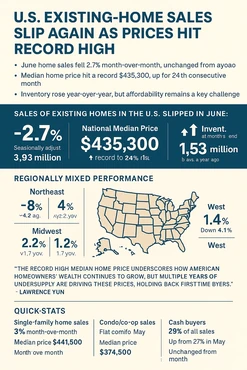

Buyers are stymied by high prices, interest rates and lack of supply

- June home sales fell 2.7% month-over-month; unchanged from a year ago

-

Median home price hit a record $435,300, up for the 24th consecutive month

-

Inventory rose year-over-year, but affordability remains a key challenge

Sales of existing homes in the U.S. slipped in June as high mortgage rates and continued housing supply constraints put pressure on buyers, according to the National Association of REALTORS (NAR).

Total existing-home sales dropped 2.7% from May to a seasonally adjusted annual rate of 3.93 million. While that figure is unchanged compared to June 2024, it reflects the prolonged stagnation of the housing market amid affordability challenges. Sales declined in three of four major U.S. regions, with only the West seeing a modest uptick.

At the same time, the national median home price rose to a record $435,300 in June2% higher than one year agomarking the 24th straight month of annual price increases.

Regionally mixed performance

The Northeast experienced the sharpest month-over-month drop, down 8% to an annual rate of 460,000 homes. Sales also fell 4.2% from June 2024. The Midwest and South saw respective monthly decreases of 4% and 2.2%, though both recorded slight gains year-over-year. The West bucked the trend with a 1.4% increase in monthly sales, though that region remains down 4.1% compared to a year ago.

Inventory and market conditions

Housing inventory at the end of June stood at 1.53 million units, up 15.9% from a year earlier and representing a 4.7-month supply at the current sales pace. Thats a slight increase from May and a notable improvement from the 4-month supply in June 2024.

Properties typically remained on the market for 27 daysunchanged from May but longer than the 22-day average from a year ago. First-time buyers accounted for 30% of purchases, a modest improvement from 29% in June 2024.

Investor activity fell to its lowest level since September 2022, with individual investors or second-home buyers making up just 14% of transactions.

Yun: High prices reflect wealth gains but undersupply persists

NAR Chief Economist Lawrence Yun emphasized that while rising home values are building household wealth, they also highlight the deepening affordability crisis. The record high median home price underscores how American homeowners wealth continues to grow, Yun said. But multiple years of undersupply are driving these prices, holding back first-time buyers.

Yun pointed to long-standing underbuilding and population growth as the root causes. More supply is needed to increase the share of first-time homebuyers in the coming years, even though some markets appear to have a temporary oversupply at the moment, he added.

Quick Stats

-

Single-family home sales:Down 3% month-over-month; median price $441,500

-

Condo/co-op sales:Flat vs. May; median price $374,500

-

Cash buyers:29% of all sales, up from 27% in May

-

Distressed sales:3%, unchanged from last month

Mortgage rates remain a sticking point

The average 30-year fixed mortgage rate was 6.75% as of July 17, according to Freddie Mac. Thats down slightly from a year ago but still high enough to keep many potential buyers sidelined.

If rates were to fall to 6%, we estimate that an additional 160,000 renters could become first-time homeowners, Yun noted. He said a rate drop in the second half of 2025 could boost sales nationally, especially with continued income growth and a strong job market.

Posted: 2025-07-23 15:03:37