ustomers of Capital Ones 360 Savings account may be eligible for compensation.

-

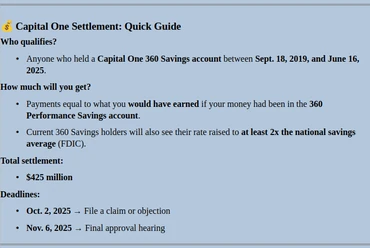

$425 million class action deal: Customers of Capital Ones 360 Savings account may be eligible for compensation.

-

Alleged $2 billion in lost interest: Regulators said Capital One froze rates at 0.3% while competitors and its own newer account paid much more.

-

Claims deadline Oct. 2: Settlement awaits court approval, with a final hearing set for Nov. 6.

If you had a Capital One 360 Savings account between September 2019 and June 2025, you may soon be entitled to a payout. The bank has agreed to a $425 million settlement to resolve allegations that it misled customers about the returns on its flagship savings product.

The settlement follows a 2024 class action lawsuit filed by customers in federal court in Alexandria, Virginia. Earlier this year, the Consumer Financial Protection Bureau (CFPB) also sued Capital One, charging that the bank cost consumers more than $2 billion in lost interest. Although the CFPB dropped its case in February, the class action moved forward leading to this large settlement.

What Capital One was accused of

Capital One heavily marketed its 360 Savings account as a high-interest, variable-rate product that would pay among the nations best yields. In practice, however, the bank allegedly froze rates at just 0.3%, even as national interest rates climbed rapidly during 2022.

Meanwhile, Capital One launched a separate 360 Performance Savings account, which eventually offered rates as high as 4.3%. Customers of the older 360 Savings account were never notified of the newer, higher-earning option, according to filings.

The CFPB called the banks earlier advertising false or otherwise misleading.

Who qualifies for payment

Anyone who held a Capital One 360 Savings account between Sept. 18, 2019, and June 16, 2025 qualifies for settlement payments.

How much will customers receive

Payments will be based on what account holders would have earned if their money had been in the 360 Performance Savings account during the same period.

In addition, customers who still maintain a 360 Savings account will see their interest rates raised. Under the terms of the settlement, the account will now earn a rate that is at least twice the national average savings rate, as calculated by the FDIC.

Key dates

-

Oct. 2, 2025: Deadline to submit a claim or file objections.

-

Nov. 6, 2025: Court hearing scheduled for final settlement approval.

Posted: 2025-08-14 15:45:14