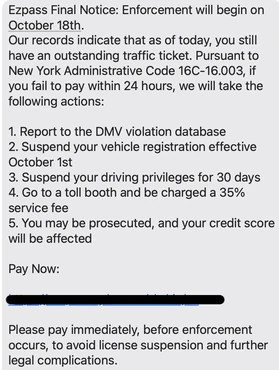

Texts demanding payment for tolls, tickets, etc., should be ignored. Go to the source to confirm.

-

Investigators say scam toll and postal texts are part of a billion-dollar phishing operation run by criminal networks in China.

-

Fraudsters use SIM farms, phishing sites and gig mules to load stolen card numbers into mobile wallets and buy gift cards, phones and other goods.

-

Law enforcement warns the scheme is growing: one firm reported a single-day high of 330,000 toll-scam messages last month.

Criminal networks operating out of China have turned text-message phishing into a sophisticated, billion-dollar industry that preys on Americans momentary lapses of attention and then launders the proceeds through U.S.-based gig workers, investigators say.

The operation typically begins with a fake text: a past-due highway toll, a bogus U.S. Postal Service fee or an alleged unpaid traffic ticket from a city agency. Victims who click the link are taken to a phishing site that harvests names, credit-card numbers, and one-time passwords. Those credentials are then used to add stolen cards to mobile wallets in Asia a trick that, investigators say, eliminates the need for repeated authentication when the cards are used remotely.

Department of Homeland Security agents and cybersecurity researchers describe a multi-step supply chain behind the fraud. At the top are foreign servers and SIM farms rooms filled with networking devices and hundreds of SIM cards that allow a single operator to send the volume of texts normally generated by thousands of phones. The overseas gangs often manage those farms remotely, recruiting U.S.-based workers via apps such as WeChat to set up the hardware locally.

To monetize the stolen information, the gangs recruit hundreds of U.S.-based gig workers sometimes called mules who are paid tiny fees to buy gift cards or high-value goods and ship them overseas. Investigators say the workers typically earn roughly 12 cents for every $100 in gift cards they purchase for the fraudsters. On any given day, as many as 400 to 500 mules are active, according toestimates.

The fraud has real, measurable scale. Proofpoint, a mobile spam-filtering firm, recorded an all-time high of about 330,000 toll-scam messages in a single day last month and says the average monthly volume of those messages is roughly 3 times what it was in January 2024. Homeland Security officials say the criminal networks behind the toll and postage texts have siphoned off more than $1 billion over the past three years.

Experts warn the rise of mobile wallets has made the fraud particularly damaging. Having these cards put into digital wallets is so powerful because multi-factor authentication is never needed again, said a threat researcher. Once a card is trusted on a device, banks and merchants may not ask for additional verification when it is used.

Law enforcement officials say the response must be multi-pronged: take down phishing infrastructure, disrupt SIM-farm operations, and chase the payment chains into criminal marketplaces. They also urge tougher enforcement against the domestic networks that set up infrastructure and recruit local mules.

Prevention tips for readers

-

Treat unexpected payment texts with suspicion dont click links.

-

If you think a message might be legitimate, go directly to the services official website or app rather than following a text link.

-

Never enter one-time passwords or full card details on a site reached from a suspicious message.

-

Monitor your accounts and enable transaction alerts from your bank.

-

Consider using a credit card rather than a debit card for online payments; review card protections with your issuer.

What to do if you think you were scammed

-

Contact your bank or card issuer immediately and report the fraud. Request a block and reissue of the card.

-

Change passwords for accounts that may have been compromised, and enable two-factor authentication where possible.

-

Check your mobile-wallet settings and remove any unfamiliar devices or cards.

-

File a complaint with the Federal Trade Commission at identitytheft.gov and report the scam to local law enforcement.

-

If you purchased gift cards or shipped goods, keep receipts and tracking numbers for investigators.

The surge in scam texts has turned a century-old phishing technique into a cross-border industrial operation. Officials say curbing it will require cooperation among tech platforms, banks, law enforcement and the public and vigilance from anyone who receives an unexpected request to pay a bill by text.

Posted: 2025-10-17 13:59:29