You now need a six-figure income to afford a $400,000 home

A new report from the National Association of Home Builders (NAHB) paints a sobering picture of the American housing market, highlighting a growing chasm between home prices and what most households can afford. The 2025 Priced-Out Analysis, released this week, underscores a persistent affordability crisis that continues to squeeze millions of families out of homeownership.

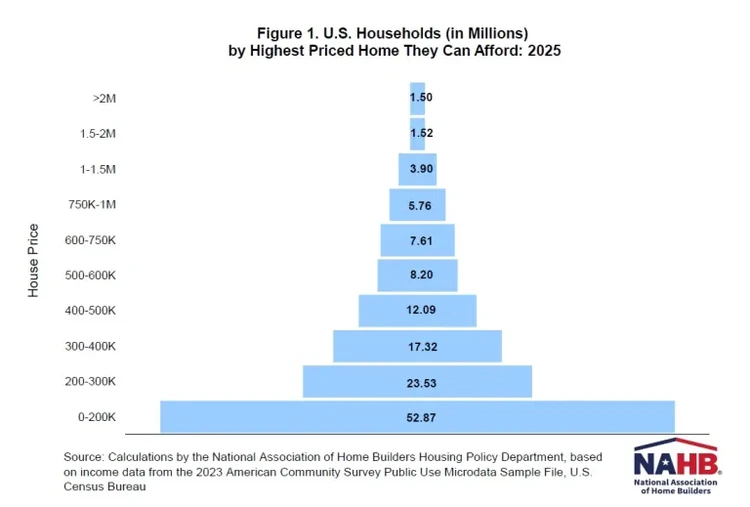

At the center of NAHBs report is the Housing Affordability Pyramid, a visualization of how many U.S. households can afford homes at various price tiers. The data reveals that 70% of American householdsapproximately 94 millioncannot afford a $400,000 home, even though the median price for a new home is expected to reach $460,000 in 2025.

The pyramid is structured around income brackets and underwriting standards, with each tier representing a price range and the number of households that can afford homes within that band. The largest cohort52.87 million householdscan afford homes priced at $200,000 or less, forming the broad base of the pyramid. Yet, a minimum income of $61,487 is still needed to qualify for a $200,000 mortgage at a 6.5% interest rate.

Above this base, the pyramid narrows sharply. The second tier, representing homes between $200,000 and $300,000, includes 23.53 million households. Fewer households can afford homes at each successive price level, culminating in the apex of the pyramid where only a small number of ultra-wealthy buyers can purchase homes priced over $2 million.

A shortage of affordable homes

Perhaps more troubling than the affordability gap is the mismatch between what people can afford and whats available on the market. While more than 53 million households can afford a $200,000 home, there are only 22 million owner-occupied homes in this price range. The mismatch persists in the $200,000$300,000 range as well, where demand still far outpaces supply.

This imbalance makes the affordability crisis worse by limiting options for low- and middle-income families, effectively locking many out of the housing market. It also puts upward pressure on home prices in the lower tiers, intensifying competition and contributing to housing insecurity.

NAHB said its analysis reinforces the urgency of addressing the housing shortage and ensuring that supply aligns with actual household income levels.

Sign up below for The Daily Consumer, our newsletter on the latest consumer news, including recalls, scams, lawsuits and more.

Posted: 2025-04-03 11:24:46